Building the future together

Tackling Climate Change

HSBC GIF Global Equity Climate Change

The HSBC GIF Global Equity Climate Change Fund aims to provide long term capital growth and income by investing in a portfolio of shares. In particular, the Fund invests in companies that may benefit from the transition to a low carbon economy by having a higher environmental, social and governance rating compared to the MSCI AC World Net Index. The Fund main investment theme focuses on energy transition/ decarbonisation and aims to capture theme – solutions across the following nine sub-themes:

Why does climate change matter?

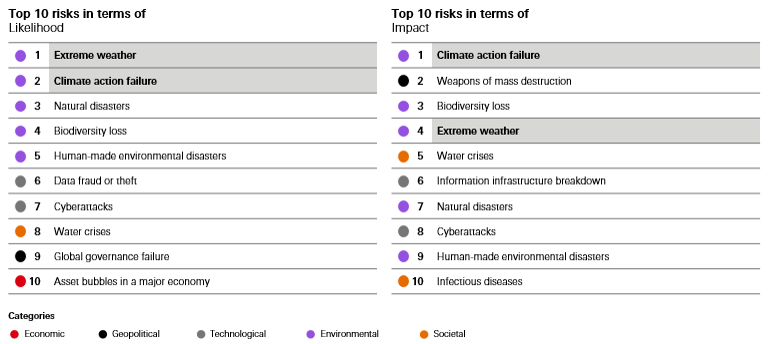

Climate change is one of the most complex issues facing us today. The impacts include more extreme weather and natural disasters, accelerating biodiversity loss and economic instability. From an investment perspective, climate change is ranked as the number one long-term investment risk and impacts company business models and earnings in three likely ways:

- regulation or policies

- direct

- physical impacts and liability

HSBC Asset Management’s climate change policy is aimed at increasing the climate resilience of our clients’ investments, as well as contributing towards financing the transition to a low-carbon economy. As such, the HGIF Global Equity Climate Change fund was launched as part of our commitment to developing solutions to support the transition to a lower carbon future.

World Economic Forum Global Risks Perception Survey 2020, 15th edition

Why invest in HSBC GIF Global Equity Climate Change?

Climate change is creating new markets and investment opportunities with investment candidates are found across Asia, Europe and North America, in Developed Markets and Emerging Markets, within all industries, and across the market cap spectrum Through it’s pure thematic approach the fund aims to develop a high conviction portfolio that provide attractive returns whilst investing in companies that offer innovative and impactful solutions tackling climate change.

|

|

|

|

|

|

|

|

|

|

|

|

Fund details

|

Fund domicile |

UCITS IV Luxembourg SICAV |

|

Fund Inception date |

9 November 2007 |

|

Base currency |

USD |

|

Recommended investment horizon |

Minimum 5 years |

|

ISIN |

AC : LU0323239441 |

|

Fees (maximum) |

Management Fee: 1.5% |

|

Minimum initial investment |

AC : USD 5,000 |

|

Fund is available at: |

HSBC Singapore |

Investor Resources

|

|

|

-

Sustainable investments

Solutions based on client need, designed to mitigate risk and capture opportunities around environmental, social and governance (ESG) issues. -

Important information

Risk

The value of an investment in the portfolios and any income from them can go down as well as up and as with any investment you may not receive back the amount originally invested.

- Exchange rate risk: Investing in assets denominated in a currency other than that of the investor’s own currency perspective exposes the value of the investment to exchange rate fluctuations

- Derivative risk: The value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivative. Unlike exchange traded derivatives, over-the-counter (OTC) derivatives have credit risk associated with the counterparty or institution facilitating the trade

- Emerging market risk: Emerging economies typically exhibit higher levels of investment risk. Markets are not always well regulated or efficient and investments can be affected by reduced liquidity.

- Liquidity risk: Liquidity is a measure of how easily an investment can be converted to cash without a loss of capital and/or income in the process. The value of assets may be significantly impacted by liquidity risk during adverse market conditions.

- Operational risk: The main risks are related to systems and process failures. Investment processes are overseen by independent risk functions which are subject to independent audit and supervised by regulators.

- Concentration risk: Funds with a narrow or concentrated investment strategy may experience higher risk and return fluctuations and lower liquidity than funds with a broader portfolio

This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

This advertisement has not been reviewed by the Monetary Authority of Singapore. This document is for information only and is not an investment recommendation, research, or advice. Any views and opinions expressed are subject to change without notice. It does not have regard to the specific investment objectives, financial situation, or needs of any specific person. Investors and potential investors should not invest in the Fund solely based on the information provided in this document and should read the prospectus (including the risk warnings) and the product highlights sheets, which are available upon request at HSBC Asset Management (Singapore) Limited (“AMSG”) or our authorised distributors, before investing. You should seek advice from a financial adviser. Investment involves risk. Past performance of the managers and the funds, and any forecasts on the economy, stock or bond market, or economic trends that are targeted by the funds, are not indicative of future performance. The value of the units of the funds and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may affect significantly the value of the investment. AMSG has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information.

HSBC Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: www.assetmanagement.hsbc.com/sg

Company Registration No. 198602036R