Sustainable investing

Introduction

As the global economy evolves to address sustainability issues, companies that most effectively manage the opportunities and risks it creates should be better positioned for long-term success.

A careful consideration of ESG issues plays a key and integral part in how we unlock sustainable investment opportunities.

What are the ESG considerations?

Environmental (E)How companies are making an impact on the |

Social (S)How companies engage with and impact their |

Governance (G)How a company is governed, what oversight |

Adding value through ESG

Asia is increasingly becoming more committed to leadership in ESG, with the region home to plenty of the companies with strong ESG models.

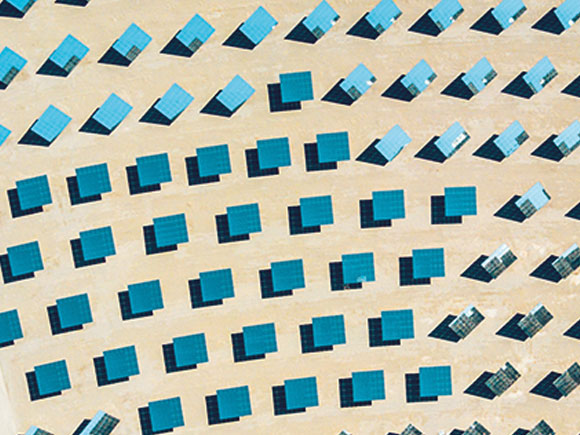

What is a lower-carbon investment strategy?

As climate-related risks materialise and carbon is more effectively priced, a lower-carbon investment strategy could mitigate the downside risks and create opportunities:

Managing climate change risksLower the impacts from climate |

Leveraging GREEN opportunitiesCapture opportunities from companies |

Staying flexibleGrade companies according to their |

Resources

ESG going mainstream

Environmental, Social and Governance (ESG) as a concept has gained wide currency in recent years. As the financial market attaches increasing importance to it, a growing number of companies also consider the inclusion of ESG factors into their operational principles an imperative. Such strategy helps build a better world, reduce damage to the environment and society, and create wonderful opportunities.

HSBC GIF Lower Carbon

The HSBC GIF Lower Carbon Fund aims to provide long term total return by investing in a portfolio of corporate bonds seeking a lower carbon footprint than its reference benchmark (Bloomberg Barclays Global Aggregate Corporates Diversified Index Hedged USD).

Our achievements

|

Lower carbon thematic funds – the |

Awarded the “Outstanding Sustainable |

Retained A+ top score for responsible |

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.