HSBC Global Investment Funds – Singapore Dollar Income Bond Fund

Important Information

- The Fund invests in normal market conditions a minimum of 90% of its net assets in:

- Singapore Dollar denominated Investment Grade and Non-Investment Grade rated fixed income, unrated fixed income and other similar securities issued or guaranteed by governments, government agencies or supranational bodies or issued by companies.

- Investment Grade and Non-Investment Grade rated fixed income, unrated fixed income and other similar securities which are denominated in non-SGD currencies and hedged to SGD. These securities will primarily be issued or guaranteed by governments, government agencies or supranational bodies in Asia or issued by companies which are domiciled in, based in, or carry out the larger part of their business in Asia.

- It is expected that the Fund's primary currency exposure will be to the SGD. The Fund may have exposure to non-SGD currencies, including developed market and Emerging Market currencies, which will be hedged into SGD. Investors may be affected adversely by exchange controls and exchange rate fluctuations.

- The Fund's unit value can go up as well as down, and any capital invested in the Fund may be at risk.

- The Fund invests in bonds whose value generally falls when interest rates rise. This risk is typically greater the longer the maturity of a bond investment and the higher its credit quality. The issuers of certain bonds, could become unwilling or unable to make payments on their bonds and default. Bonds that are in default may become hard to sell or worthless.

- The Fund may invest in Emerging Markets, these markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

- Derivatives may be used by the Fund, and these can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

- Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

- Further information on the Fund's potential risks can be found in the Key Investor Information Document and Prospectus.

HSBC Global Investment Funds – Singapore Dollar Income Bond Fund

The fund invests in a portfolio of bonds denominated in or hedged to Singapore Dollars (SGD). The fund aims to invests across Asia, providing good diversification across sectors and countries

Why invest in SGD Bonds?

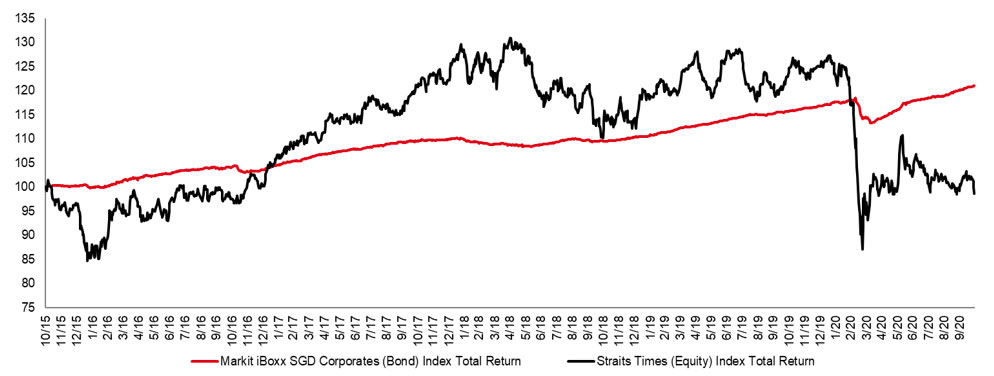

Resilience and stability

- Singapore dollar bonds offer returns with much less volatility versus equities

Source: Markit, Bloomberg, data as of 29 October 2020. Investment involves risks. Past performance is not indicative of future performance. For illustrative purpose only and does not constitute investment advice.

Past performance and any forecasts on the economy, stock or bond market, or economic trends that are targeted by the funds are not indicative of future performance.

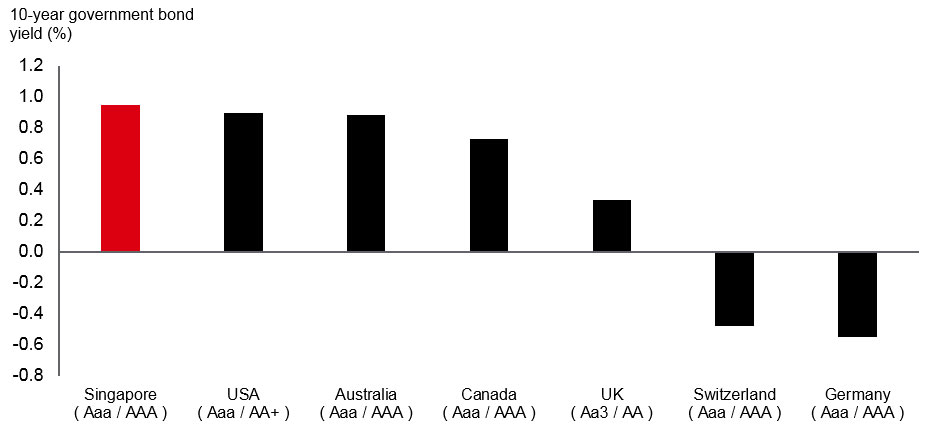

Growing market and appealing yields

- The SGD bond market has grown over the years to reach SGD 489 billion (USD358 billion)

- It is primarily dominated by sovereign bonds, quasi-sovereigns as well as bank and real estate corporates

- SG sovereign bonds offer higher yields compared to other developed markets

Source: JPMorgan, Bloomberg HSBC Asset Management, data as of 13 November 2020. Credit rating is presented as Moody's /S&P

Investment involves risk. Past performance is not indicative of future performance. For illustrative purposes only

Past performance and any forecasts on the economy, stock or bond market, or economic trends that are targeted by the funds are not indicative of future performance.

Solid macro fundamentals

- Singapore as a country offers investors solid macro fundamentals such as political and economic stability backed by strong monetary policies

- The country holds official foreign exchange reserves of over USD350 billion, the 11th highest FX reserves in the world1

- The Singapore Government also provides a investor-friendly framework and Foreign investment in Singapore’s bond market is unrestricted

Source: Monetary Authority of Singapore Official Foreign Reserves. Data is as of 7 December 2020.

Why consider the Fund?

|

Prudent credit management

|

A regular income in SGD

|

|

Portfolio diversification

|

Management from a strong, stable, award winning team

|

Source: HSBC Asset Management, data as of August 2020

*Dividend is not guaranteed and may be paid out of capital, which will result in capital erosion and reduction in net asset value. A positive distribution yield does not imply a positive return. Past payout yields and payments do not represent future payout yields and payments. Historical payments may comprised of both distributed income and capital. The annualized dividend yield is calculated based on the dividend distribution on the relevant date with dividend reinvested, and may be higher or lower than the actual annual dividend yield.

For illustrative purposes only. Representative overview of the investment process, which may differ by product, client mandate or market conditions. Awards won by HSBC Asset Management includes Best of the Best Awards for Asian Bond House category by Asia Asset Management 2015, 2016, 2017, 2018, 2020. Past performance of the managers are not indicative of future performance.

Resources

-

SGD Income Bond Fund Brochure

Download the SGD Income Bond Brochure -

Visit Fund Centre

Fund factsheets, performance data, prices and other information about this fund

Error message: There is an error with the ImagePromo component. Please check the log for more information

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Investors and potential investors should not invest in the Fund solely based on the information provided in this document and should read the prospectus (including the risk warnings) and the product highlights sheets, which are available upon request at HSBC Asset Management (Singapore) Limited (“AMSG”) or our authorised distributors, before investing. You should seek advice from a financial adviser. Investment involves risk. Past performance of the managers and the funds, and any forecasts on the economy, stock or bond market, or economic trends that are targeted by the funds, are not indicative of future performance. The value of the units of the funds and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may affect significantly the value of the investment. AMSG has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information.

HSBC Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: www.assetmanagement.hsbc.com/sg

Company Registration No. 198602036R