Why not India?

India’s recent ascent into the global spotlight seems undeniable and arguably inevitable given the litany of positive catalysts – robust growth, improved macro stability, strong structural tailwinds, and continuing economic reforms - spurring it on.

Though India remains a relatively bright spot amid a challenging global environment there are questions around how various external (tighter global financial conditions, higher oil prices, risk of recession in the US and European economies in 2024) and domestic (inflation, upcoming election cycle) factors could potentially derail what seems to be India’s star turn. There are also other fundamental concerns around the pricey valuations of Indian equities and the impact of the recent index inclusion announcement on Indian bonds that are likely giving some global investors pause at this time.

In this article, our experts weigh in on the most pressing investor questions regarding investing in India, balancing potential risks and rewards and reinforcing our conviction in what we believe is India’s decade.

Q. Global macro headwinds are a significant concern for most major economies. What makes India uniquely positioned in this environment?

Risk of “high(er)-for-longer” US rate narrative

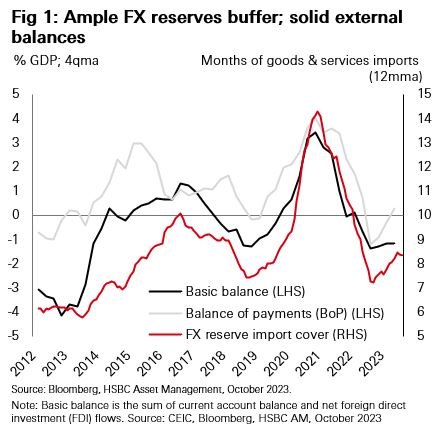

The recent rise in long-term US Treasury yields, amid market concerns about a “higher-for-longer” Fed rate narrative and a wider US fiscal deficit, has tightened global financial conditions and weighed on capital flows into emerging markets (EM). This in turn has exerted pressure on EM and Indian sovereign bonds and currencies. However, the INR has shown relative resilience, thanks to its solid macroeconomic fundamentals and the Reserve Bank of India’s (RBI) FX management during periods of volatility. India’s ample foreign reserves (see Fig. 1) provides the RBI with sufficient ammunition to defend the INR if necessary. Furthermore, we think the global rate environment could shift materially in 2024, as the US economy falling into recession would lead the Fed to begin cutting rates.

The outlook for India’s balance of payments (BOP) is supported by its strong growth prospects, robust services exports and remittance inflows, prospects for a structural uptrend in foreign direct investment (FDI), and expectations for increased foreign fund flows in 2024–25 due to India’s inclusion in the GBI-EM bond index (and the potential of other global indices to follow suit). A higher foreign participation rate in the local bond market will help to broaden and diversify the investor base, improve market liquidity and deepen domestic capital markets. It could also potentially lower India’s cost of funding, though it means increased exposure to global financial volatility and the need for fiscal prudence and policies consistent with macroeconomic stability.

India’s banking sector has been relatively resilient and stable despite the heighted global uncertainty, helped by stable credit growth, improved asset quality, adequate capital and liquidity buffers, and greater regulatory over-sight for both banks and non-bank financial institutions.

Risk of supply-side oil price shocks

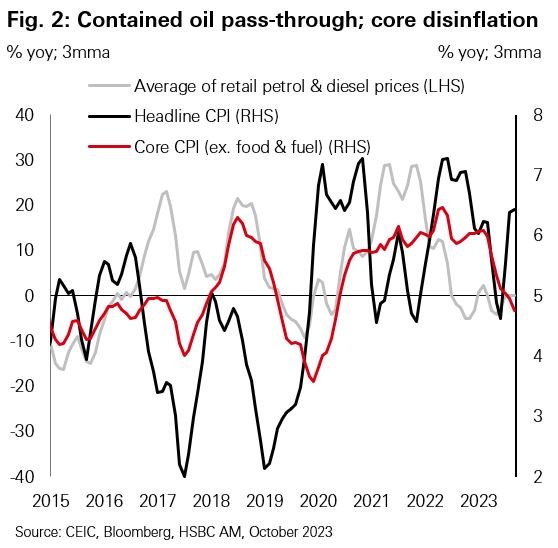

Crude oil price movements have important implications for India’s macro stability risks, given India imports more than 85 per cent of its crude oil requirements. Any sustained and sharp rise in oil prices would have an adverse impact on India’s inflation, trade/current account and fiscal balances. The pass-through of higher oil prices could also increase the cost of production and transportation for various sectors, weighing on profit margins, and reducing consumers’ disposable income. So far, however, the impact from higher inflation has been largely contained by the government’s policy intervention. Domestic petrol and diesel prices have been unchanged since May 2022, and the government has announced a cut in cooking gas prices to ease cost of living pressures. Policy intervention is likely to remain in place, in the run-up to the election cycle and amid sticky food ex. vegetable price inflation and lukewarm rural demand.

Near-term inflation risks also emanate from adverse weather patterns, such as El Niño and the erratic monsoon rainfall distribution, impacting crop yields especially in the case of rice and pulses. Key to watch in the near term would be how rice and pulse production and prices evolve alongside news about winter crop sowing.

Higher oil prices will raise the import bill. Every USD10 rise in Brent prices could lead to a 0.3-0.5 per cent of GDP increase in India’s current account deficit, based on street estimates. Meanwhile, government efforts to manage food prices–by increasing agricultural imports and discouraging agricultural exports–and stable domestic demand growth may also push up imports. That said, several favourable macro trends should help keep India’s BOP at a sustainable level.

Higher oil prices are negative for India’s fiscal balance, but the exact impact is hard to gauge. The combination of retail fuel price controls in the short term (costs borne by oil marketing companies) and an eventual higher subsidy bill (loss-sharing by the government) or tax cuts means the fiscal impact reflected both on- and off-budget. The government has estimated that the immediate fiscal cost of the LPG price cut is minimal, but more fiscal measures to control inflation and support rural incomes are expected in a pre-election year.

Fiscal and trade policy intervention to tackle energy and food price inflation eases pressure on monetary reactions, though supply-side risks could delay any dovish pivot. The RBI has vowed to be vigilant against the risk of food and fuel price rises which could lead to more generalised and persistent inflation. That said, the RBI could take comfort from the recent core disinflation. While tight supply concerns will likely continue to support oil prices, a sharp or sustained supply-driven increase in energy prices would weaken global demand. Overall, we expect the RBI to likely keep policy rates on hold through FY24 and focus on liquidity management. We see some scope for policy easing in FY25, amid easing underlying inflation and as we expect the Fed to start cutting rates.

Q. India’s reform agenda and policy continuity have been important considerations for investors in the past decade. What are the risks to these catalysts going into the election year?

The election calendar is heating up. Five state elections will take place in November, with results out on 3 December. Investors will likely weigh the implications of these polls for the general elections expected in April-May 2024), though Indian voters tend to vote differently in state and national elections, as state elections tend to be fought more on local issues. Prime Minister Narendra Modi’s ruling Bharatiya Janata Party (BJP) will be seeking a third term. Meanwhile, 28 opposition parties across states have formed a grand alliance called the Indian National Developmental Inclusive Alliance (INDIA). Early opinion polls point to a political status-quo and policy continuity in the general elections, though surveys suggest some discontent among voters on issues such as rural recovery, jobs and inflation. We are still at a relatively early stage of the election cycle and the political landscape could still change.

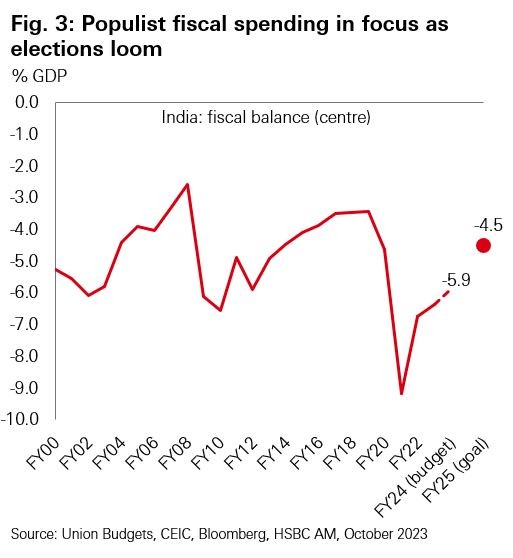

As elections approach, the focus is now on potential pro-voter policies or an increase in populist spending, such as the extension of the Covid-era free food programme–which offers 5 kg of food grains free of cost to a majority of the population and is scheduled to end in December 2023, or higher cash transfers to small farmers. While any populist shift could add to inflationary and fiscal pressures, we think the government would tilt towards pro-rural, pro-social spending over the coming months within fiscal boundaries, along with the ongoing focus on infrastructure spending. Healthy revenue growth has supported a gradual pace of fiscal consolidation.

Elections may slow or temporarily delay further progress in major structural reforms. But the reform momentum is likely to pick up afterwards, particularly if there is a strong mandate for the next government. Decisive election results ensuring political stability would improve policy certainty and remove the market overhang. An election outcome of a weak coalition government could potentially face more populist pressures and raise market concerns about the prospects for effective policymaking and reform implementation.

However, regardless of the election outcome, structural tailwinds would continue to support India’s growth potential helped by the significant reform progress witnessed thus far and certain supportive secular global trends, such as supply-chain diversification and renewable energy transition, etc.

Q. The recent index inclusion announcement indicates that allocation to emerging markets can be sufficient to gain India exposure. Why does India deserve standalone allocation?

In fixed income, India’s local currency bonds have always lacked global index representation and will only start to be included in emerging market indices beginning in June 2024, as confirmed in JPMorgan’s recent announcement. This long-awaited decision was welcomed by the market and is a significant positive for India bonds, though the inclusion news has also raised questions on whether global investors need to even to allocate separately to India since exposure could be seemingly achieved via a broader emerging market allocation. But by just allocating to emerging markets, investors may miss out on the potential benefits from investing in a standalone India fixed income strategy, particularly given the following considerations:

- India bonds eligible in JPMorgan’s indices are government bonds under the Fully Accessible Route (FAR) with a residual maturity of 2.5 years (from 28 June 2024) (i.e., FAR India government bonds maturing after 31 December 2026). A standalone India fixed income strategy can adopt a more flexible approach and invest in attractive government bond opportunities that fall outside of the index inclusion eligibility

- As INR corporate bonds are also not considered for index inclusion, an India fixed income strategy that takes positions across government, quasi-government and corporate bonds could result in a better diversified investment

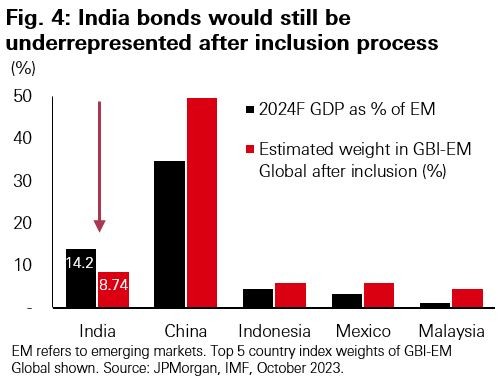

- India is the second largest economy in emerging markets by far and would still remain underrepresented in bond indices after the inclusion – India’s index weighting is expected to reach a maximum of 10 per cent in JPMorgan’s GBI-EM Global Diversified Index and 8.7 per cent in the GBI-EM Global Index – in the latter index, where there is no 10 per cent cap on country allocation, China makes up half of the index (Fig. 4)

- Further, in our India fixed income strategy, we strategically use both INR bonds and India USD bonds opportunistically – an approach that allows us to navigate and potentially benefit from both the Indian and US monetary cycles

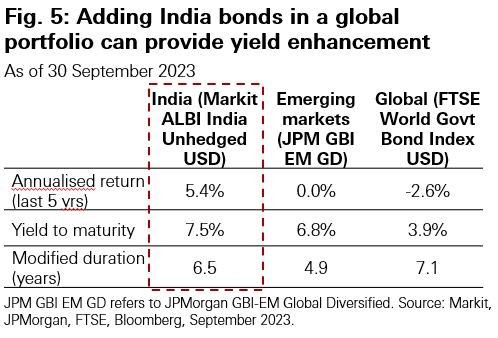

- India domestic bonds are not included in global bond indices, such as FTSE WGBI. Adding India bonds (which yields 7.5 per cent) in a global bond portfolio (FTSE WGBI yields 3.9 per cent) can potentially enhance yields and provide diversification benefits (Fig.5)

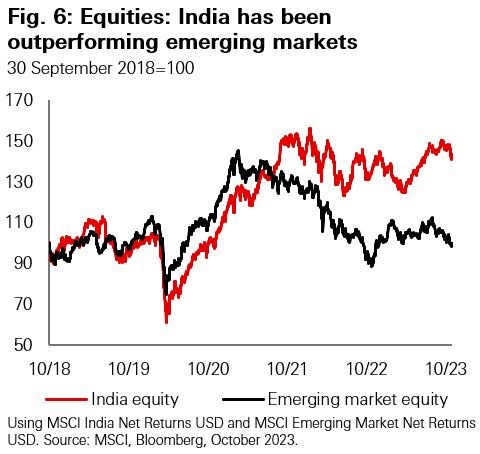

In equity, India is included in emerging market and global equity indices but heavy China weighting and underrepresentation may warrant standalone allocation:

- India’s weight in the MSCI Emerging Market Index has increased from 8.7 per cent five years ago to the current 15.9 per cent.1 Standalone allocation can give investors an opportunity to stay ahead of the curve and benefit from potential further increase in India’s index weight

- In the global context, India has the fifth largest equity market in the world with a market cap of USD 3.7 trillion, but only it makes up 1.5 per cent of the MSCI AC World Index.1 India is also underrepresented when compared to India’s significant 7.5 per cent contribution to world GDP2

- Indian equity is exposed to strong earnings growth and new economy sectors as more unicorns get listed. Investors can benefit from bottom up security selection, such as in our India equity strategy, with there being potential alpha that can be achieved in a dedicated India equity investment

Q. These past few months have proved to be difficult for fixed income assets. What makes now the time to look at India bonds?

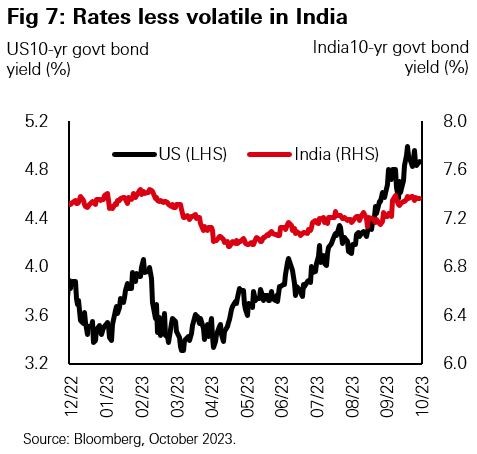

Global bond yields have been moving higher, and as seen in the earlier section, there is a risk of a higher-for-longer narrative on the US rates front. The Indian bond markets, though, have been less volatile relative to global bond markets. The confirmation of index inclusion of India government bonds has cushioned the impact of global market volatility to some extent. While the Reserve Bank of India’s (RBI) monetary policy in early October came in as expected, the reference to open market operation (OMO) sales in the RBI governor’s statement was not anticipated by the market, and this led to a negative reaction after the RBI meeting.

Rates globally could remain volatile, and against this backdrop and given the overhang of potential OMO sales, the India bond markets have seen further correction with yields moving higher. However, as observed a few times in the past, reversal from such points can be sharper than the move up (in yields). Hence, we believe that any correction can provide an opportunity to add India exposure as this is a good entry point.

Overall, factors appear to have aligned for the investment case for India fixed income:

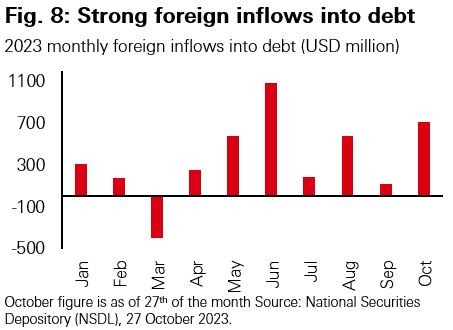

- The INR currency should see potential upside in the coming months, boosted by the index inclusion. Year-to-date, Indian debt inflows have been strong and has more than reversed the 2022 outflows (Fig. 8). In Indian equities, while flows year-to-date remains solid, flows in the recent months have been under pressure with the surge in US bond yields. We would likely see that JPMorgan’s index inclusion flows, which is expected to total USD 20-25 billion, would begin sooner than the index inclusion start date of June 2024

- A number of support factors from the macroeconomic side are also aligning in favor of India bonds: India’s improved current account helped by an uptrend in services exports, the cooler inflation, and the peak in policy rates with the expectations of rate cuts in in 2024 are all beneficial for India bonds

- At 7.4 per cent yield for its 10-year government bonds, India – as an investment grade market – provides a substantial yield pick up against other investment grade bonds. Even with the recent volatility in global rates, India’s yield is significantly higher than that of the US at 4.9 per cent, and remains well above China’s 2.7 per cent3

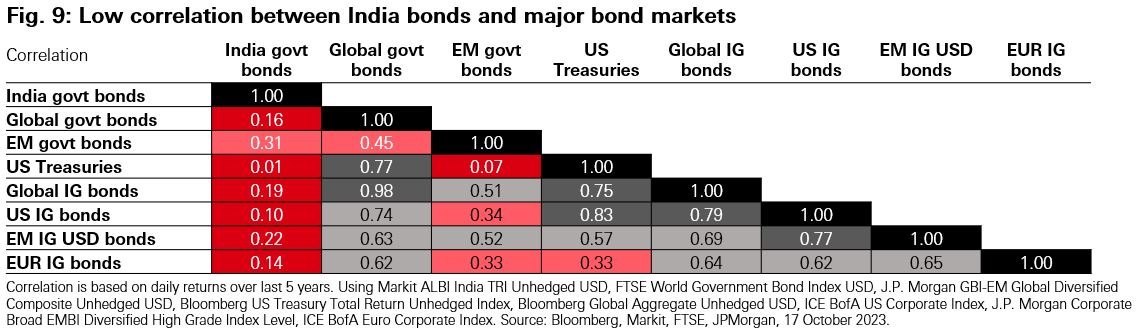

- An important diversification benefit can be gained from an allocation to India fixed income, particularly with the low correlation the asset class exhibits against other major bond markets (Fig. 9)

Q. Indian equities seem to be the most expensive among major markets. Are the current valuations justified?

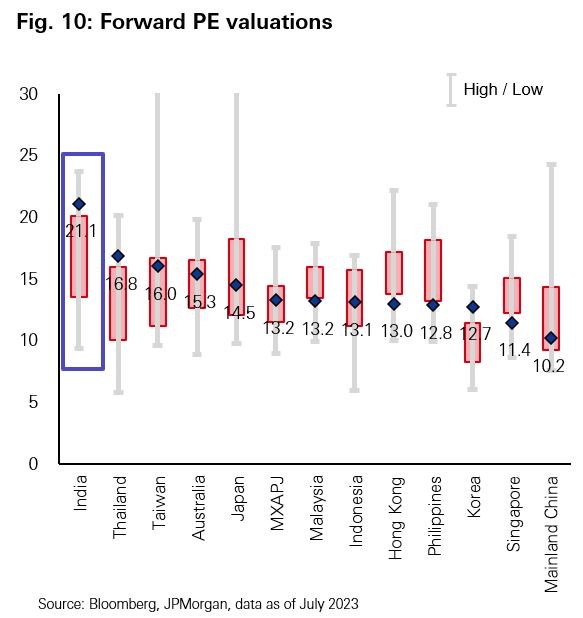

Though valuations of Indian equities appear expensive when compared to major emerging and developed markets, they remain reasonable when viewed against their own long-term averages. Indian equities are currently trading at 21.1x forward price-to-earnings ratio, very close to its five-year average of 20x (Fig. 10). Another point to note is that the relative premium to global equities is equally driven by the de-rating of other major markets such as China during the same period that Indian stocks have rallied sharply.

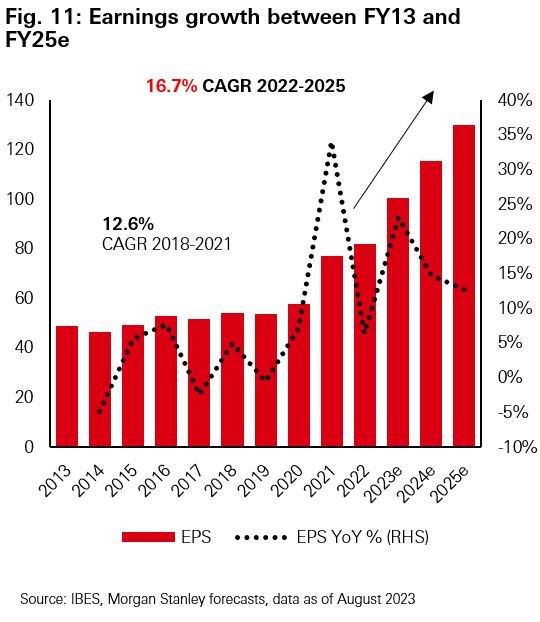

Relative valuations only tell a part of the story though as India arguably stands apart when it comes to earnings visibility and growth prospects. For instance, earnings growth between 2022-2025 is expected to come in at 16.7 per cent per annum following the 12.6 per cent growth per year witnessed between 2018-2021 as Indian companies are set to benefit from a slew of ongoing reforms and structural changes such as digitalisation, infrastructure spending, energy transition and the reorganisation of the global supply chain (Fig. 11).

In contrast, earnings growth of US equities is projected to be largely flat for 2023, on the back of the Fed’s higher for longer narrative, a strong dollar environment and bond yields at levels not seen since 2007.

We believe that superior earnings growth coupled with a longer runway of economic growth, favorable macro backdrop and supportive government policies make the case for a long-term investment allocation into Indian equities. The market also remains uncrowded at present with foreign institutional investors’ (FIIs) ownership of NSE500 companies still recovering after bottoming out in September 2022. The most eager buyers of Indian stocks remain local retail investors (through monthly investment plans, the flows into which have doubled since the pandemic) and domestic institutions who act as a much-needed counter-balance to foreign flows, reducing volatility and providing liquidity.

While equity market returns in medium to long term are typically a function of earnings and growth expectations, they tend to work with some sort of lead/lag, with markets at times performing ahead of earnings growth and at other times waiting for a stronger confirmation of sustainability or magnitude of earnings growth. When it comes to the Indian equity market, an argument can be made that the mid and small cap parts of the market may have run ahead of themselves with their sharp outperformance in recent months. However, the same is not true of large cap stocks which have registered much more modest short-term gains but have a history of stable returns and a comparatively favourable risk/return profile.

Source: HSBC Asset Management, Bloomberg, October 2023.

Note 1: Source is Bloomberg, MSCI, October 2023.

Note 2: Source is IMF, October 2023. Source: HSBC Asset Management, JPMorgan, MSCI, October 2023.

Note 3: Source is Bloomberg, 30 October 2023.

Investment involves risks. Past performance is not indicative of future performance. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. For illustrative purposes only.

This publication is intended for Professional Clients and intermediaries’ internal use only and should not be distributed to or relied upon by Retail Clients. The information contained in this publication is not intended as investment advice or recommendation. Non contractual document. This commentary provides a high level overview of the recent economic environment, and is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. The performance figures displayed in the document relate to the past and past performance should not be seen as an indication of future returns. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in Canada and the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The capital invested in the fund can increase or decrease and is not guaranteed. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, fund manager’s skill, fund risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

•In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

•In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

•in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

•in Canada by HSBC Global Asset Management (Canada) Limited which provides its services as a dealer in all provinces of Canada except Prince Edward Island and also provides services in Northwest Territories. HSBC Global Asset Management (Canada) Limited provides its services as an advisor in all provinces of Canada except Prince Edward Island;

•in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

•in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

•in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

•in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

•in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

•in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission;

•in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

•In Israel, HSBC Bank plc (Israel Branch) is regulated by the Bank of Israel. This document is only directed in Israel to qualified investors (under the Investment advice, Investment marketing and Investment portfolio management law-1995) of the Israeli Branch of HBEU for their own use only and is not intended for distribution;

•in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

•in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

•in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Bank Middle East Limited which are regulated by relevant local Central Banks for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority.

•in Oman by HSBC Bank Oman S.A.O.G regulated by Central Bank of Oman and Capital Market Authority of Oman;

•in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

•in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore;

•in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website at https://www.assetmanagement.hsbc.ch/ if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

•in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

•in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

•and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.