The case for infrastructure debt

What is the scale of the infrastructure opportunity?

Infrastructure underpins the 21st century global economy. From power networks and digital connectivity to renewable energy and social assets, infrastructure provides critical services with long-term demand drivers. These assets are often supported by regulated frameworks or long-term contracts that deliver returns through economic cycles.

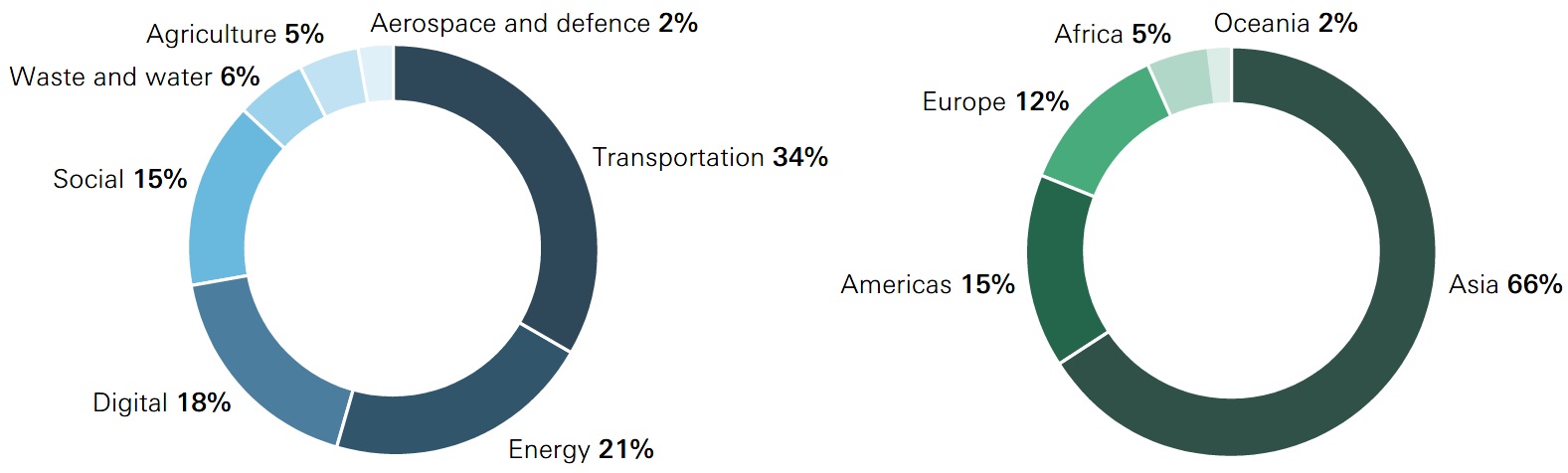

Statistics illustrate the scale of investment in infrastructure required to meet growing demand. McKinsey estimates that a cumulative USD 106 trillion will be needed by 2040 across seven critical infrastructure verticals, including transport and logistics, energy and power, and digital by 2040 1.

Global infrastructure investment to 2040

Source: McKinsey (2025) using data from Food and Agriculture Organisation; Global Infrastructure Hub; International Energy Agency; International Monetary Fund; Organisation for Economic Co-operation and Development; Pregin; United Nations; World Bank; World Economic Forum; McKinsey Analysis.

Focusing on sustainability, the OECD estimates that USD 6.9 trillion in infrastructure investment is required every year to 2030 to align with the UN Sustainable Development Goals and the Paris Agreement 2.

Infrastructure has long been viewed as a core building block in institutional multi-asset portfolios for its ability to deliver stable, inflation-linked returns supported by essential real-world assets.

And in a world increasingly shaped by technological progress, geopolitical shifts, and demographic forces, the case for infrastructure investing becomes particularly strong.

Over the past 10 years, global private infrastructure assets under management have increased over fourfold reaching approximately USD 1.3 trillion as of mid-2024 3 at a compound annual growth rate of nearly 20 per cent. Infrastructure AUM is expected to reach USD 2.8 trillion by 2028 4. Today, infrastructure represents over 5 per cent of institutional portfolios – an increase of over 40 basis points year-over-year 5.

Investors are drawn to three key benefits that infrastructure offers:

- Predictable cashflows with some inflation linkage

- Resilience through economic cycles as utilisation of core networks and services remains largely stable, even through downturns

- Access to high-quality assets aligned to long-term megatrends, including digitalisation, decarbonisation, and deglobalisation

Why invest in infrastructure debt?

Within the infrastructure asset class, infrastructure debt offers a distinctive risk-return profile. Infrastructure debt are loans and bonds secured against infrastructure assets and companies. This debt is often senior in the capital structure, secured on tangible assets and contracted cashflows, with covenants that give lenders information and control.

Infrastructure debt financing from commercial institutions (mainly banks and institutional lenders) accounted for USD 600 billion – USD 1 trillion annually from 2018-2022 6. This includes primary financing (construction or ‘greenfield’ assets), refinancing and acquisition finance. This segment of the market is what is generally understood as infrastructure debt.

Infrastructure debt can be further separated into:

- Project financing, where the debt financing relies on cash flows and security from a ring-fenced, stand-alone infrastructure asset (or portfolio of assets), and

- Corporate financing, where the financing relies on the cash flows and assets of a broader corporate involved in the infrastructure sector

Geographically, North America and Europe are the largest markets (around one third each), with the balance including Asia-Pacific, Latin America, Middle East, North Africa, and Sub-Saharan Africa.

One of the key benefits of infrastructure debt is that it can offer attractive yields with downside protection. Infrastructure debt has exhibited lower credit losses than similarly rated corporate debt, due to structural protections, essential service status, and/or regulatory oversight 7.

Robust credit performance of infrastructure debt

Infrastructure debt can deliver attractive returns due to a combination of:

- A straightforward business plan

- Contracted revenues

- Support through government control or regulation

- High barriers to entry

- More covenants and monitoring by the lenders compared to a typical corporate financing

- A comprehensive security package that would improve recovery following a default

Which secular themes are accessible through infrastructure debt?

Over the past decade, the infrastructure market has grown rapidly on the back of a global infrastructure gap, the development of renewable energy, and the digital revolution, the latter driving projects such as data centres and fibre to home. Much of this infrastructure has been developed by a growing number of infrastructure equity funds, alongside traditional sponsors, both of which rely on debt funding as part of their investment cases.

Energy transition

The transition to a net zero economy by 2050 embodied in the Paris Agreement is very much an infrastructure story. Net zero requires an urgent and unprecedented scale of transformation of multiple sectors across the global economy. BloombergNEF estimates that global energy transition investment needs to rise to USD 5.6 trillion per year from 2025-2030, up from USD 2.1 trillion in 2024 to stay on track for net zero by 2050 8. The International Energy Agency (IEA) forecasts that annual global electricity grid investment must rise from USD 140 billion in 2023 to USD 200 billion by the mid-2030s to meet rising electricity needs, and to approximately double (to USD 250-300 billion) to successfully achieve national and global emissions goals 9.

Both developed and emerging economies have a key role to play in ensuring investment is scaled up quickly and in a co-ordinated way to ensure a just and sustainable energy transition. Governments in the US, EU, and UK, among other jurisdictions, are expected to provide material policy support for energy transition investments.

The projects required to successfully decarbonise the economy include renewable energy (solar, wind, and hydroelectric), battery storage, and transmission upgrades. All of these require significant capital expenditure, and many are financed with long-dated project debt backed by contracted offtake agreements 10 or regulated tariff frameworks.

Infrastructure debt allows investors to participate in growth opportunities associated with the energy transition through secured exposure to the enabling assets and contracted cashflows.

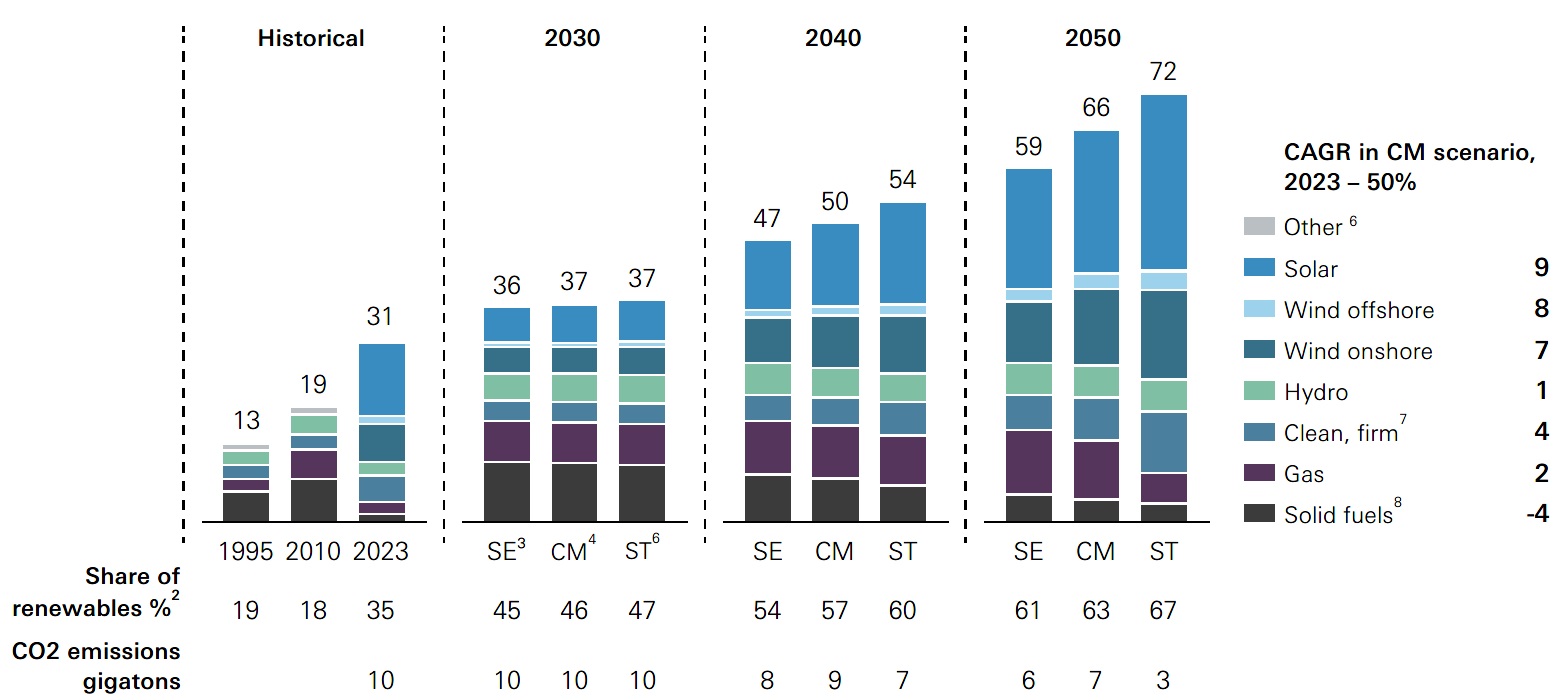

The chart overleaf illustrates the scale of the renewable energy opportunity. Renewables have the potential to provide up to 67 per cent of the global power mix by 2050 11.

The infrastructure market has grown rapidly on the back of a global infrastructure gap, the development of renewable energy, and the digital revolution.

Global power generation1 to 2050 (thousands of terawatt-hours)

1. Excludes generation from storage (batteries, long-duration energy storage, and pumped hydro). 2. Includes bioenergy with carbon capture and storage, geothermal, hydro, hydrogen-fired gas turbines, solar, and wind. 3. Slow Evolution scenario. 4. Continued Momentum scenario. 5. Sustainable Transformation scenario. 6. Includes bioenergy (with and without carbon capture, utilization, and storage) and oil. 7. Includes coal and gas with carbon capture, utilization, and storage; geothermal; hydrogen; and nuclear. 8. Includes thermal coal and biomass. Source: Energy Solutions by McKinsey (2025).

Digitalisation and AI

The digital economy requires an array of infrastructure, including hyperscale data centres, cloud campuses, fibre optics, and installation of 5G. Major technology firms have issued hundreds of billions of dollars to finance AI and data centre infrastructure. AI-related capex is expected to drive a significant share of US investment grade issuance in coming years. Loans and bond sales by technology groups in 2025 has doubled to USD 700 billion (as of 20 Nov 2025) 12. The top five hyperscalers are expected to spend USD 602 billion in 2026, up 36 per cent year-over-year, driven by unprecedented AI infrastructure investments and capacity constraints 13.

Recent research suggests that renewable energy remains the fastest and cheapest way to add power to the grid, which will be critical to meeting the massive energy demands of the digital economy. Battery storage systems, solar arrays, and wind farms are faster and cheaper to build per kilowatt of capacity than other energy sources 14. Complementing onsite natural gas turbines with solar panels or batteries means data centres can achieve a faster connection to the grid because they will represent less of a demand stress when electricity is tight 15.

Private infrastructure lenders are increasingly financing data centres, fibre networks, tower portfolios, and edge infrastructure through structured senior loans with contracted revenues and robust security over assets.

Equally, public institutions are mobilising billions through programmes like the European Investment Bank’s Tech EU Initiative, which is targeting digital infrastructure and clean technologies 16.

The intersections between infrastructure required for digitalisation and the energy transition highlight the need for an integrated investment approach that addresses infrastructure needs across verticals.

Transportation and user-pay assets

Transport corridors including railways, toll roads, ports, and bridges are the lifeblood of economies, facilitating trade, job creation, social connectivity, and economic growth.

The transportation and logistics sector requires USD 36 trillion in projected investment according to McKinsey 2, which cites countries challenged by aging roads, congested ports, and strained public transit systems, while also needing to decarbonise freight, aviation, and passenger mobility.

In many countries, transport assets operate under concession agreements that combine regulated tariff frameworks with usage-linked revenues. These assets tend to exhibit relatively stable traffic volumes, driven by long-terms including rising urbanisation and trade.

Debt secured on transport assets typically benefits from:

- Security arising from tangible physical assets and associated concession rights

- Contractual protections, including step-in rights, reserve accounts, and covenants

- Often, index-linked tariffs, providing some inflation protection

Infrastructure debt allows exposure to these critical assets that are the backbone of the economy, while avoiding equity-like volatility. For many institutions, this combination of secular growth, resilience, and structural protection is attractive in a long-term allocation.

Which regions do you find attractive?

The US and Europe offer the deepest, most institutionally investable pipelines for infrastructure debt. Both regions have transparent regulation, robust contractual frameworks, and high-quality sponsors.

In the US, large-scale federal programmes such as the Inflation Reduction Act and Infrastructure Investment and Jobs Act (Biden-era legislation largely preserved by the Trump administration), combined with strong state-level procurement, and a mature project finance ecosystem, are generating a sustained flow of opportunities across clean energy, transmission, transportation, and digital infrastructure.

The Trump administration’s One Big Beautiful Bill Act, signed into law in July 2025 extends broad tax cuts, while altering clean energy incentives. For infrastructure debt investors this creates both risks and opportunities, but a clearer tax and regulatory regime could well support underwriting and financing of domestic infrastructure assets.

Europe is also an attractive investment environment. The European Green Deal and related initiatives are channelling capital into green infrastructure and digital connectivity. Similarly, national energy transition strategies and the rapid expansion of offshore wind interconnection projects and fibre, are creating structural demand for long-dated debt.

Finally, Asia offers growing opportunities, driven by rapid urbanisation, renewable energy growth, digital infrastructure expansion, and supportive public sectors. Australia, South Korea, and Japan offer strong governance and transparent regulation, particularly beneficial for infrastructure debt deployment.

Why should investors consider HSBC Asset Management for infrastructure debt?

Various considerations are important when evaluating an infrastructure debt manager, including origination access, underwriting discipline, and governance.

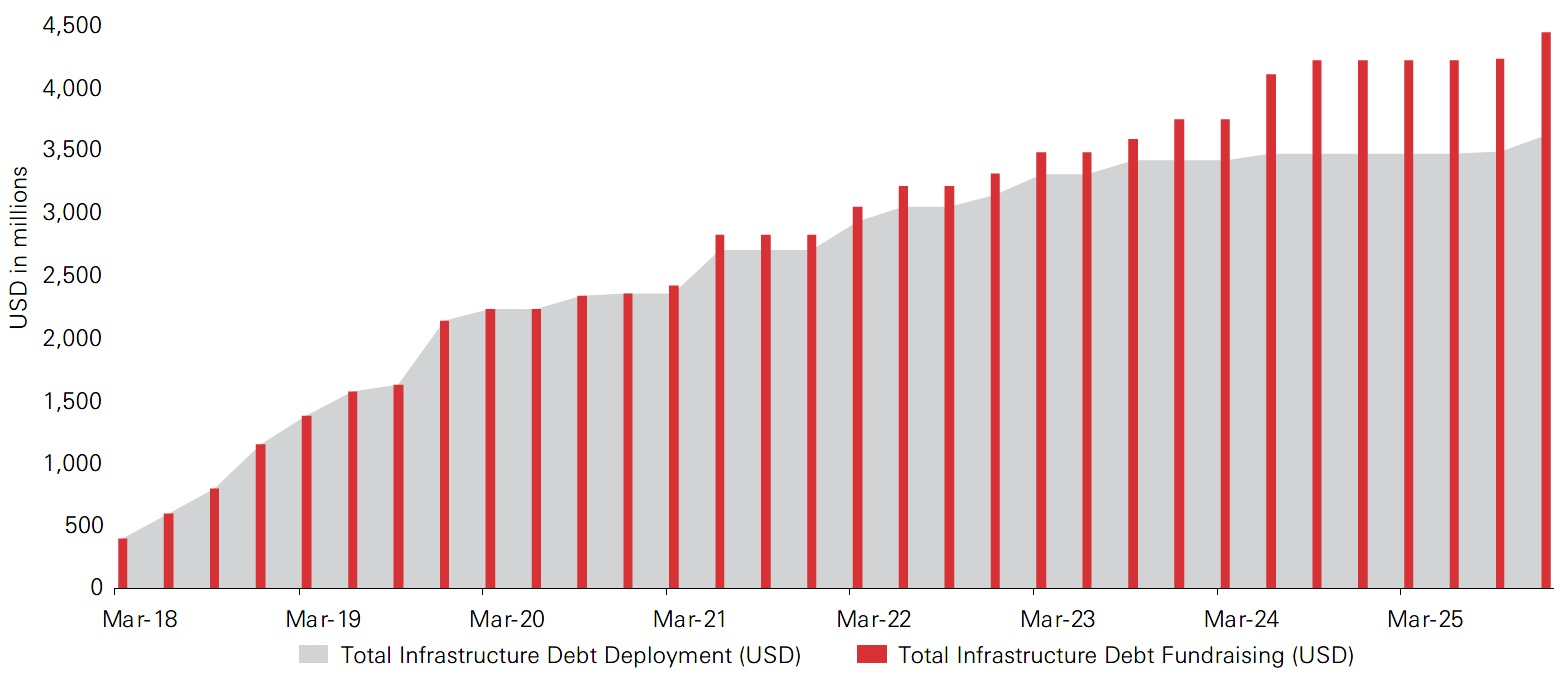

HSBC Group has a longstanding history in the infrastructure finance market. We launched our first infrastructure debt mandate in March 2018 and today we manage USD 4.3 billion in global infrastructure debt across over 100 investments.

Established infrastructure debt platform: Growing at scale while staying selective

Source: HSBC Asset Management (January 2026). HSBC AM Alternatives manages USD11.6 billion across all infrastructure products (debt and equity).

Our investment team can leverage HSBC Group’s extensive relationships and brand to source the best relative value opportunities, access transactions in fast growing markets, efficiently build significant deal flow, and enhance portfolio diversification. Our investment team can also leverage its relationships with other international and national banks to help achieve our objectives.

Our key strengths include:

- Global origination with local insight: We have access to a broad pipeline across the US and Europe through HSBC’s corporate, project finance, and investment banking franchises. Our analysts are specialists in sectors, including the energy transition and digital infrastructure

- Robust credit underwriting: We emphasise senior secured structures, covenanted deals, and robust documentation

- Disciplined portfolio construction: We ensure diversification across sectors, geographies, and borrower types with limits on individual name and sponsors. We have a focus on downside protection, with rigorous stress testing, and scenario analysis

- Integrated ESG and climate analysis: We systematically assess environmental, social, and governance risks and opportunities in all deals. We have expertise in energy transition investing, which contributes to net zero goals, economic resilience, and inclusive growth

- Transparent, institutional reporting: We provide detailed asset-level reporting and risk analytics to support regulatory and internal model requirements for insurers and pension funds

Describe HSBC AM Alternatives’ approach to infrastructure debt investing

- Our objective for the HSBC Global Infrastructure Debt Fund (GIDF) is to provide attractive risk-adjusted returns with a predictable income stream by investing in a diversified portfolio of loans (and other debt instruments) with infrastructure characteristics. In our Global Transition Infrastructure Debt Fund (GTIDF), we target deals which either are, or will, contribute to greenhouse gas emissions reduction and the global transition to net zero. The gross target return of GIDF is 10-12 per cent and of GTIDF is 8-10 per cent (both in USD)

- Through GIDF and GTIDF we lend to a mixture of infrastructure projects and corporates, especially those in the lower mid-market where we see a large volume of opportunities and where there is less competition, which supports pricing, and lenders typically have a stronger negotiating position. Some of the investments in our portfolios may be related to businesses or other opportunities that are in development or construction

- Our geographic focus is primarily on investment grade-rated countries in Europe, North America, Australasia and Asia. We believe this geographic remit enables us to build a well-diversified portfolio based in stable countries with well-established and supportive legal frameworks for financiers

HSBC Group has a longstanding history in the infrastructure finance market.

Can you provide an example of a deal you’ve invested in recently?

The International Energy Agency has called for scaling up solar power rapidly this decade. Renewable sources of electricity generation are expected to more than double by 2030, with solar PV accounting for around 80 per cent of the global increase in renewable power capacity 18.

Against this backdrop, HSBC Asset Management (through its Global Transition Infrastructure Debt Fund (GTIDF)) provided a USD 24 million debt financing package for UrbanVolt, a leading Irish solar-as-a-service provider. This was an HSBC-exclusive transaction, completed in partnership with HSBC Innovation Banking, following the introduction by HSBC CIB Europe.

UrbanVolt has a diversified portfolio of operational solar PV projects underpinned by long-term contracted revenues with commercial and industrial customers in Ireland and the UK. The company is backed by an experienced private equity sponsor with a proven track record in European renewables.

Through this investment, HSBC has supported the deployment of more solar PV systems, helping businesses in Ireland and the UK reduce electricity costs by up to 50 per cent with no capital outlay. The investment also contributes to the transition to renewable energy, aligning with HSBC’s commitment to environmental sustainability. We look forward to evaluating more opportunities in this space amid a fast-growing commercial and industrial rooftop solar market.

Building the future

As global infrastructure enters a decisive build-out phase, now is a great time to invest in infrastructure debt. The asset class offers contracted income and downside protection, allowing investors to earn stable and attractive long-term returns allied to global themes, including the energy transition, digitalisation, and demographic change.

This document provides a high level overview of the recent economic environment. It is for marketing purposes and does not constitute investment research, investment advice nor a recommendation to any reader of this content to buy or sell investments. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination

1 ‘Investing in bridges to bandwidth’, McKinsey (2025)

2 ‘Infrastructure for a Climate-Resilient Future’, OECD (2024)

3 ‘Private Equity Infrastructure Investment Poised for Renewed Growth Amid Evolving Market Dynamics’, BCG (2025)

4 ‘Responsible Investment in Infrastructure’, Malk Partners (Q2 2025)

5 ‘Institutional Infrastructure Allocations Monitor’, Hodes Weill & Associates (2025)

6 ‘Annual 2023 report’, IJ Global (2023) Does not include infrastructure projects directly financed by government agencies.

7 ‘Infrastructure Debt: A Compelling Private Credit Portfolio Allocation’ Markets Group (2025)

8 ‘Energy Transition Investment Trends 2025’, BloombergNEF (2025)

9 ‘Building the Future Transmission Grid’, IEA (2025)

10 An offtake agreement is a legally binding contract between a producer and buyer to purchase or sell part of the producer’s upcoming goods.

11 ‘Global Energy Perspective 2025’, McKinsey (2025)

12 ‘Bond investors hitch one-way ride on AI big dipper’, Reuters (2025)

13 ‘Technology: Hyperscaler Capex 2026 Estimates’, CreditSights (2025)

14 ‘2025 Levelised Cost of Electricity+ Report’, Lazard (2025)

15 ‘Trump’s Plan For AI Dominance Threatened by His Own Attacks on Solar, Wind Power’, Bloomberg (2025)

16 ‘TechEU’, European Investment Bank (2025)

This information shouldn't be considered as a recommendation. Past performance does not predict future returns. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Key risks

- Alternatives risk: There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily reliable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements

- Equity risk: Portfolios that invest in securities listed on a stock exchange or market could be affected by general changes in the stock market. The value of investments can go down as well as up due to equity markets movements

- Interest rate risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements

- Counterparty risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

- Derivatives risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset

- Emerging markets risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks

- Exchange rate risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly

- Investment leverage risk: Investment leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source

- Liquidity risk: Liquidity risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors

- Operational risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things

- Style risk: Different investment styles typically go in and out of favour depending on market conditions and investor sentiment

- Model risk: Model risk occurs when a financial model used in the portfolio management or valuation processes does not perform the tasks or capture the risks it was designed to. It is considered a subset of operational risk, as model risk mostly affects the portfolio that uses the model

- Sustainability risk: Sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets: investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third-party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- In Bermuda, this document is issued by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- In France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden this document is issued by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- In Germany, this document is issued by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the

- Austrian Financial Market Supervision FMA (Austrian clients);

- In Hong Kong, this document is issued by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This content has not been reviewed by the Securities and Futures Commission;

- In India, this document is issued by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- In Italy and Spain, this document is issued by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- In Malta, this document is issued by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- In Mexico, this document is issued by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- In the United Arab Emirates, this document is issued by HSBC Investment Funds (Luxembourg) S.A. – Dubai Branch (Level 20, HSBC Tower, PO Box 66, Downtown Dubai, United Arab Emirates) regulated by the Securities and Commodities Authority (SCA) in the UAE to conduct investment fund management, portfolios management, fund administration activities (SCA Category 2 license No.20200000336) and promotion activities (SCA Category 5 license No.20200000327).

- In the United Arab Emirates, this document is issued by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- In Singapore, this document is issued by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland, this document is issued by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- In Taiwan, this document is issued by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- In Turkiye, this document is issued by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- In the UK, this document is issued by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- In the US, this document is issued by HSBC Securities (USA) Inc., an HSBC broker dealer registered in the US with the Securities and Exchange Commission under the Securities Exchange Act of 1934. HSBC Securities (USA) Inc. is also a member of NYSE/FINRA/SIPC. HSBC Securities (USA) Inc. is not authorized by or registered with any other non-US regulatory authority. The contents of this document are confidential and may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose without prior written permission.

- In Chile, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Obtain information about the state guarantee to deposits at your bank or on www.cmfchile.cl

- In Colombia, HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- In Costa Rica, the Fund and any other products or services referenced in this document are not registered with the Superintendencia General de Valores (“SUGEVAL”) and no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document is directed at and intended for institutional investors only.

- In Peru, HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy

Copyright © HSBC Global Asset Management Limited 2026. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Asset Management.

Content ID: D062471; Expiry Date: 31.01.2027