Alternative Credit

Executive Summary

The investment landscape has transformed dramatically over the past decade, and the role of private credit in institutional investor portfolios has moved from a satellite investment to a core portfolio allocation, playing an important role within a new, uncertain macro environment. Not only have institutional investors continued to increase allocations to private credit, but they are also actively looking to diversify within this asset class – seeking solutions which address specific portfolio goals, in addition to providing access to idiosyncratic factors and potential for robust risk return profiles.

Pension funds and insurers are the largest investors in private credit funds globally and their allocations have increased more than six-fold in the last decade1. Many initial private credit allocations have resulted in a somewhat concentrated exposure with overlapping underlying credit risk, borrower profile, interest rate correlation and duration, even with different investment managers.

In this context, it has become increasingly clear that private credit could potentially play a much bigger role, addressing investor allocation needs that can no longer be met solely by traditional strategies, both public and private. Institutional investors continue to seek yield-generating private credit investment opportunities with shorter maturities, lower risk, or lower interest rate correlation or simply, a different return generation profile. This has resulted in significant increase in interest in several asset classes in this space, traditionally originated and retained by banks.

One of the challenges facing investors has been securing access to the origination flows and establishing adequate asset selection and portfolio management to gain that exposure efficiently. As a result, private credit managers have increasingly looked to banks and their origination platforms, aiming to secure bank origination partnerships that provide access to deal flow.

Bank-owned asset managers have naturally found themselves in prime position to execute these partnerships.

From a broader perspective, the combination of modest economic growth, coupled with increased macro and interest rate volatility may continue to put pressure on assets in the near term, leading to increased investor focus on asset classes which have proven to be resilient over the economic cycle. Many institutional investors can consider adding complementary strategies to their existing allocation, providing diversification, stronger historic credit resilience and robust downside protection whilst still generating potentially compelling illiquidity premium.

Revolving Credit Facility (RCF) Strategies

A good example of how bank-originated assets can complement existing allocations to private credit are Revolving Credit Facilities (“RCFs”), a critical operational liquidity tool.

RCF strategies provide significant diversification benefits without sacrificing yield. RCFs can generate double digit returns and diversified borrower profile by investing in large, multinational corporate borrowers with diversified operations. RCFs have proved highly resilient during economic downturns, with a much lower historic default rate, shorter duration and less interest rate sensitivity than traditional private credit strategies, a clear benefit in a volatile interest rate environment. Finally, RCFs can also provide regulatory benefits for specific pools of capital, such as insurance capital.

NAV Finance Strategies

Further collaboration opportunities are opening up in the expanding asset-backed finance space. A second partnership example is Net Asset Value (“NAV”) Finance Strategies which invest in senior secured, investment grade-rated loans. Senior Secured fund financing has historically been provided by banks but is increasingly becoming available to institutional investors. Investment grade-rated NAV loans can provide spreads in excess of 400-500 bps, similar to many sub-investment grade (“IG”) strategies, but with a shorter maturity and an IG credit rating profile. This makes NAV Finance strategies particularly compelling for investors requiring a sizeable IG-rated allocation, whilst capturing the illiquidity premium in an efficient format and without extending duration. In the case of NAV strategies, partnering with a Bank allows investment managers to tap into a wider and deeper deployment opportunity, as most banks retain large origination platforms and often a position of incumbency with many borrowers.

Trade Finance Strategies

A third example of asset-backed bank-originated assets which provide risk-adjusted diversification benefits in shorter duration allocations are Trade Finance Strategies. Trade Finance strategies offer access to high quality, short-dated, asset backed, working capital assets ranging from investment grade programs to sub-IG deal flow. Trade Finance assets generate spreads similar or higher to benchmark liquid BBBs, with a much shorter maturity (typically self-liquidating within 3–6 months) and uncorrelated to the broader market. Through a partnership with a credible and experienced Trade Finance Bank, investors can gain access to a curated, high quality deal flow with a diversified selection of underlying assets, packaged in an efficient format.

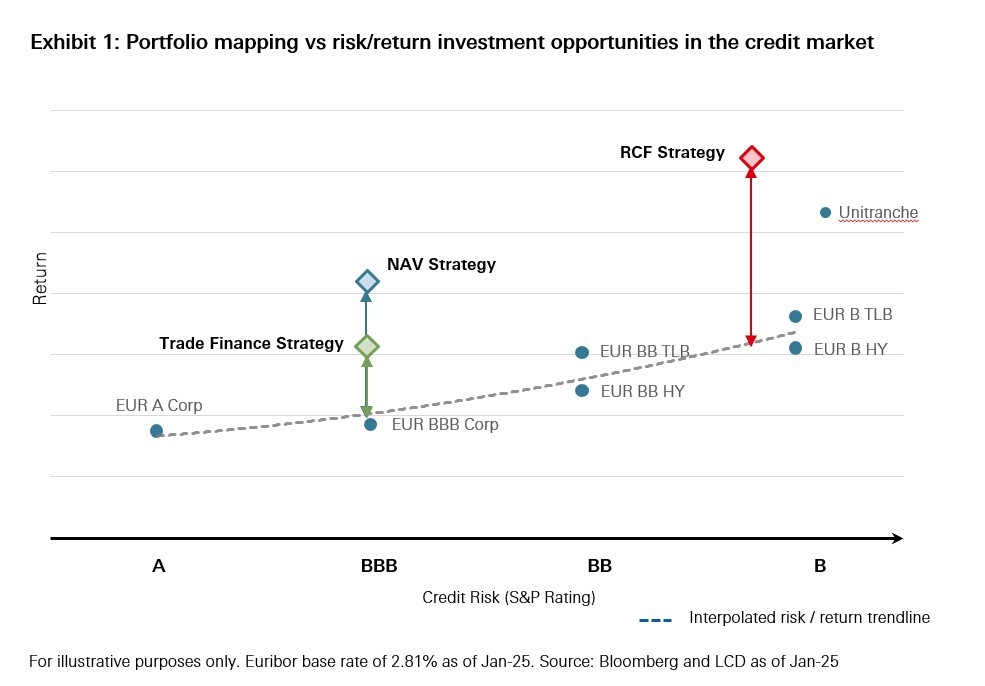

Exhibit 1 on next page illustrates the risk – returns diversification benefits offered by some of these bank-originated strategies, which complement traditional public and private credit strategies.

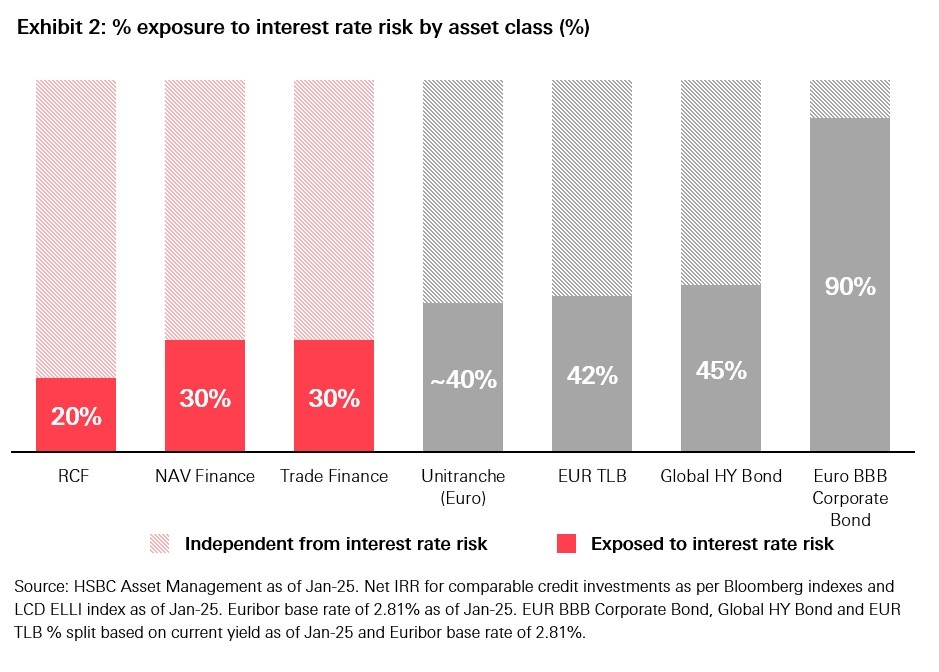

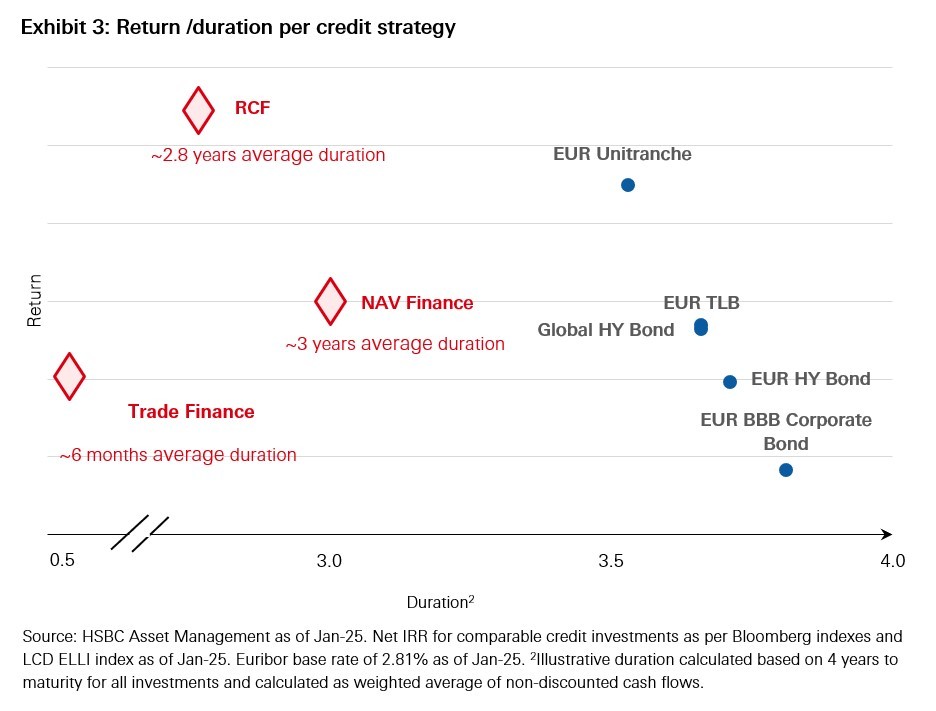

Bank-originated assets also allow institutional investors to enhance yield even in a declining rate environment, without compromising credit quality. As rates decline, traditional private credit allocation returns could be affected, driving investors to seek alternative types of private credit strategies which are less interest rate-dependent (see exhibit 2). As illustrated in exhibit 3, bank-originated assets also have shorter duration than comparable traditional allocations, an important diversification point in an increasingly uncertain macro-outlook.

Bank origination partnerships

This evolving investment landscape and the demand for different type of private credit assets, which historically have only been provided and held by banks, has created a suitable environment for asset managers and bank partnerships to thrive and develop beyond traditional corporate lending.

The increasing demand for diversification has pushed bank partnerships to innovate and offer investors access to distinctive investment opportunities, targeting specific investor outcomes, leveraging the strengths of their origination and distribution networks. These strategies tap into the strong and well-established bank pipelines while providing critical, additional asset manager investment selection and governance. Furthermore, investment managers must provide an integrated portfolio, liquidity management and structuring solution to ensure an efficient access for investors. In this new environment, bank-owned asset managers and other managers who have a deep understanding of bank deal flow, credit selection and structuring are in a strong position to provide investors with an efficient, complementary investment proposition.

Partnerships are a cornerstone to bank origination and when executed well, there is demonstrable evidence that they can deliver positive outcomes for both parties: banks continue to work with their clients while investment managers continue to develop new solutions for investors’ portfolio needs, providing compelling risk-return and diversification benefits.

Looking ahead, we expect business demand for credit to continue and adapt to new forms of activity. In parallel, we expect several key trends to continue re-shaping the bank origination landscape, resulting in new opportunities to partner with asset managers and institutional capital, generating new and compelling ways to provide a differentiated source of returns for investors.

HSBC Asset Management’s (“HSBC AM”) Alternative Credit platform provides such strategies for investors, leveraging on its proven bank partnership model. The combination of the origination agreement with HSBC Bank and HSBC AM’s independent fiduciary and governance framework, provide our highly experienced teams with an informed and balanced view of the market to identify compelling investment opportunities. Our experience underwriting risk, our understanding of how the assets behave throughout long cycles, including downturns, and our ability to construct complementary portfolios with compelling risk reward features makes our Bank Originated Credit strategies a valuable addition to Institutional investors allocations.

Past performance is not indicative of future performance. For illustrative and informational purposes only and should not be construed as a recommendation for any investment product or strategy.

1. ‘The Rise and risks of private credit’, IMF and Preqin, April 2024

Find out more about Capital Solutions

Important information

Key Risks

Risk Considerations. There is no assurance that a portfolio will achieve its investment objective or will work under all market conditions. The value of investments may go down as well as up and you may not get back the amount originally invested. Portfolios may be subject to certain additional risks, which should be considered carefully along with their investment objectives and fees.

Illiquidity: An investment in the strategy is a long-term illiquid investment. By their nature, the Fund’s investments will not generally be exchange traded. These investments will be illiquid.

Long-term horizon: Investors should expect to be locked-in for the full term of the investment

Economic conditions: The economic cycle and prevailing interest rates will impact the attractiveness of the underlying investments. Economic activity and sentiment also impacts the performance of underlying companies and will have a direct bearing on the ability of companies to keep up with interest and principal repayments.

Loans to private companies: The Fund will invest in loans to medium sized privately owned companies. There are specific risks associated with lending to such companies, including that they may have limited financial resources, access to capital and higher funding costs. They may also be more vulnerable to market, key-man and other risks and their accounts are not typically published.

Valuation: These investments may have no or a limited liquid market, and other investments including those in respect of loans and securities of private companies, may be based on estimates which cannot be marked to market until sale. The valuation of the underlying investments is therefore inherently opaque.

Strategy risk: Investments into this Fund may, among other risks, be negatively affected by adverse regulatory developments or reform, credit risk and counterparty risk. The credit market bears idiosyncratic risks such as borrower fraud, borrower bankruptcy, prepayment risk, security enforceability risk, subordination risk and lender liability risk.

Investor’s capital at risk: Investors may lose the entirety of invested capital

Alternatives: There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily realisable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements

This document is not meant for retail audience and does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment nor should it be regarded as investment research. This document has not been reviewed by the MAS.

This document is for sounding of indicative interest. HSBC Global Asset Management (Singapore) Limited (“AMSG”) has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Any views and opinions expressed in this document are subject to change without notice. It does not have regard to the specific investment objectives, financial situation, or needs of any specific person. Investors and potential investors should not make any investment solely based on the information provided in this document and should read the offering documents (including the risk warnings), before investing. Investors should seek advice from an independent financial adviser. Investment involves risk. Past performance and any forecasts on the economy, stock or bond market, or economic trends are not indicative of future performance. The value of investments and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may significantly affect the value of the investment.

This document and any other document or material issued in connection with the offer or sale is not a prospectus as defined in the Securities and Futures Act, Chapter 289 of Singapore ("SFA") and has not been registered as a prospectus with the MAS. Accordingly, statutory liability under the SFA in relation to the content of prospectuses does not apply. You should consider carefully whether the investment is suitable for you. The offer or invitation of the units, which is the subject of this document, does not relate to a collective investment scheme which is authorised by the MAS under Section 286 of the SFA or recognised by the MAS under Section 287 of the SFA and the units are not allowed to be offered to the retail public.

No document or material in connection with the offer or sale of the units may be circulated or distributed, nor may the units be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than to an institutional investor pursuant to Section 304 of the SFA, in accordance with the conditions specified in that section, (ii) to a relevant person pursuant to Section 305(1), or any person pursuant to Section 305(2), and in accordance with the conditions specified in Section 305 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the units are subscribed or purchased under Section 305 of the SFA by a relevant person which is (a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or (b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, the securities (as defined in Section 239 of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferable within 6 months after that corporation or that trust has acquired the units pursuant to an offer made under Section 305 of the SFA except (1) to an institutional investor or to a relevant person as defined in Section 305(5) of the SFA, or to any person arising from an offer referred to in Section 275(1A) or Section 305A(3) of the SFA; (2) where no consideration is or will be given for the transfer; (3) where the transfer is by operation of law; or (4) as specified in Section 305A(5) of the SFA.

This document is provided upon request for information only.

In Singapore, this document is issued by AMSG who is licensed by MAS to conduct Fund Management Regulated Activity in Singapore. AMSG is not licensed to carry out asset or fund management activities outside of Singapore.

HSBC Global Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: https://www.assetmanagement.hsbc.com.sg/

Company Registration No. 198602036R