HSBC Asset Management – First Half 2022 Business Update

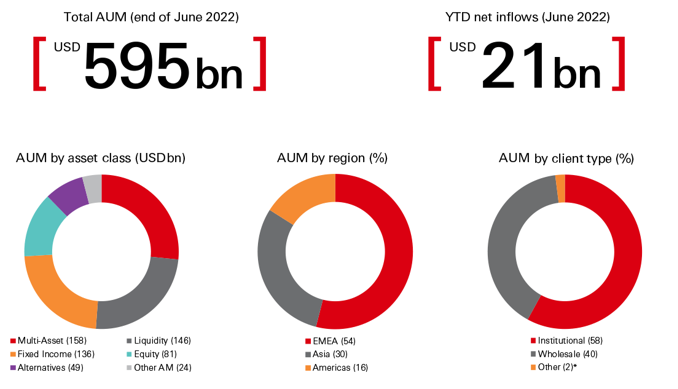

- Asset Management’s AUM stands at USD595bn as of 30 June 2022

- This includes USD21bn of net new money from clients year to date

- We continue to make strong progress to deliver our ‘Five by Five’ strategy and open up a world of opportunity for clients

Our performance

We have achieved another strong set of results, despite a backdrop of high inflation and turbulent markets. This demonstrates the momentum and resilience that we have built in the business, thanks to your hard work and dedication.

Our Assets Under Management (AUM) stand at USD595bn as of 30 June, with USD21bn in net new client money year to date. This includes an impressive USD16bn of net new money in the second quarter alone. The decrease we have seen in our overall AUM is across asset classes and due to market performance and turbulent market conditions so far this financial year.

Please click on the image above to download a higher res version. Assets Under Management are presented on a Distributed (AUD) basis

The above view includes Associates (such as Jintrust) and is presented on Reported FX rates

“Other AM” in Asset Class refers to HASE

“Other” in client type refers to Jintrust assets

Our strategic progress

In the last quarter, we have:

- Continued to deliver investment excellence. Across the 12-month period to the end of May 2022, 77 per cent of our key funds outperformed their respective benchmarks (on an asset weighted basis), a significant increase year-on-year (68 per cent).

- Demonstrated our commitment to expand our global client base and Asian footprint with the launch of the HSBC Jintrust New Era Balanced Fund (Times Vanguard fund) in June, receiving over USD150m from all distributors. This was the largest equity/balanced fund IPO during its launch period and the second largest in the past three months. We also achieved an important milestone for our alternative private debt franchise by raising USD110m for the UK Senior Direct Lending Fund from six institutional clients in South Korea, broadening our investor base in the region.

- Continued to deliver first class investment solutions to our clients to meet their evolving needs, including launching 17 new funds so far this year.

- Further cemented our ambition to build leadership in sustainable investments, a key priority for us. Our team in Taiwan secured a mandate from one of the largest pension funds in Asia to manage a USD460 million offshore Enhanced Global Climate Change Equity fund. In addition, the HSBC Sterling ESG Liquidity Fund reached its first significant AUM milestone – GBP500m in just six months.

- Taken another stride to establish a global Alternatives franchise by launching Capital Solutions Group, a new unit that will be created within HSBC Alternatives to offer flexible capital solutions to HSBC's wholesale clients and other selected market participants.

- Embraced technology to compete with a cost-efficient platform by delivering a new, automated workflow for client reporting. This has, for example, enabled 40 per cent faster delivery of client reporting for HSBC Alternatives.

- Continued to energise for growth and inclusion by joining the ‘30 per cent Club’ and committing to having 30 per cent women in senior leadership roles, with an aspiration of reaching 40 per cent by 2025. Our ~250 volunteers in 14 markets have continued to deliver key DE&I activities – sponsored by our Management Committee – including implementing our Ethnic Inclusion Plan.

- Made significant progress to strengthen our brand to support growth since the launch of our always-on digital strategy, as evidenced by 37 industry award-wins in the first half of 2022.

- Continued to create long-term partnerships, such as our existing one with Climate Asset Management (CAM). We launched the CAM Natural Capital Fund earlier this year with initial aggregate commitments of USD157m and continue to see strong client demand for the fund ahead of its next close. Its third close is expected later this year, with an overall probability weighted pipeline for this strategy of c. USD400m.

Looking ahead

We continue to make great progress to provide market leading investment solutions, aligned to the sustainability transition and growth in Emerging Markets and Asia, and are firmly in growth mode.

To succeed we stay close to our clients and focus on how we can meet their evolving investment needs. We are also maintaining our focus on building a culture that fosters diversity, equity and inclusion, innovation, commerciality, and intrapreneurship.

If you have any questions about our results or funds, please CONTACT US and choose the appropriate option for you, to be directed to the right person.