ETFs

Our range of equity ETFs cover global equities in both developed and emerging markets.

Partnership in index and systematic equity

In late 2009, we launched our first ETFs in Europe and currently have a suite of 29 funds which are built on our strong index tracking heritage, integrated platforms and disciplined processes.

We take a pragmatic approach to managing ETFs with two equally important objectives: close tracking and minimising costs.

We offer equity market exposure to a range of global markets and carefully select indices where we can manage trading costs and liquidity.

Our tracking method and value-added approach to managing ETFs have enabled us to consistently produce returns that closely mirror the index within target tracking tolerances.

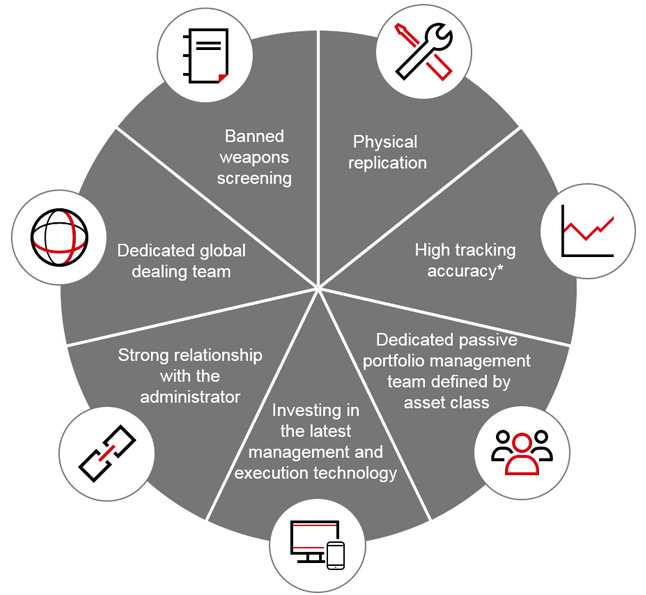

Key benefits of our ETF range

At the heart of our investment process is delivering close tracking error and managing tracking error budgets, while minimising the funds’ execution costs. We have a robust track record in providing competitively priced market access solutions.

Physical replication

Our passive equity funds benefit from our physical replication approach – where our portfolios are invested in the constituents of the underlying index, and do not use synthetic instruments, such as swaps and other derivatives, to mirror index performance.

High tracking accuracy*

Through considered implementation, we aim to find the optimal trade-off between temporary tracking error and transaction costs. The optimal balance and duration of implementation is important in achieving this objective and ultimately improves portfolio performance over time.

*Please refer to the factsheets for individual fund performance

Enhanced risk management, control and monitoring

Risk management is central to our investment process before and after investment decisions are made.

Ongoing risk management includes investment operating parameters, tracking error risk, counterparty risk, exposure risk and the accuracy of analysis of performance attributions and exposures to different parts of the underlying market.

Dedicated global dealing team

At HSBC we have traders located in key regional execution hubs. This is fundamental, as the expertise is connected to the market and exchange they operate in. This means our equity trades are handled by specialists with local knowledge, expertise and relationships, who are familiar with local service providers. At the end of the day, this can go a long way to deliver the best outcomes for investors.

Banned weapons stock screening

At HSBC we have implemented a screening of banned weapons such as cluster munitions, anti-personnel mines, chemical weapons etc. across the entire active and passive ranges – excluding investments in issuers that are involved in these weapons.

Large investment in the latest management and execution technology

Our leading proprietary technology ensures the efficiency and accuracy of information – supporting consistent tracking and fund performance. Our proprietary technology has been designed by our investment teams to meet their rigorous and robust requirements to ensure cost savings and better performance outcomes for our funds and investors

Index-based Investing - The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate.

y

y