HSBC Securitised Credit strategies

Counter uncertainty with dynamic Securitised Credit strategies

Why consider Securitised Credit?

Like a skilled fencer, HSBC’s Securitised Credit strategies balance agility with precision to navigate challenging markets. Our disciplined approach enables swift adaptations, diversifying against volatility (RIPOSTE) while building resilience against volatility (GUARD). When opportunities emerge, we reposition with dynamic allocations (SHIFT) to capture value in changing markets.

|

Guard against uncertainty

|

|

Diversify risk. Riposte to volatility

|

|

Shift allocations with agility

|

Optimise your portfolio with Securitised Credit

Securitised Credit – A strategic asset class for today’s market

In a world of low yields and rate uncertainty, investors seeks income and growth without excess risk. Securitised Credit offers a unique proposition for sophisticated investors looking to complement their traditional fixed income holdings.

Compelling yield

The current “higher-for-longer” interest rate regime is particularly favorable for this predominantly floating rate asset class. With spreads wider than their historical tights, Securitised Credit currently offers a compelling yield, while maintaining a lower duration profile than traditional fixed income or corporate credit – that helps mitigate interest rate risk.

True portfolio diversification

Securitised Credit has a historically low correlation to corporate credit and other traditional assets, and is a powerful tool for enhancing portfolio diversification and improving overall risk-adjusted returns.

A resilient performance profile

Securitised Credit has historically delivered competitive risk-adjusted returns (a strong Sharpe ratio) by combining compelling absolute returns with a lower volatility profile under both the “lower for longer” period and the current market.

Meeting the needs of a diverse range of investors through a unique asset class:

Multi-Asset and Wealth Managers

Enhanced diversification

Historically has low correlation to corporate credit and equities - a powerful tool to improve portfolio resilience and smooth returns.

Pension Funds

Yield enhancement

Offers a compelling income via yield enhancement, helping to meet liability-driven investment goals and improve funding levels.

Private Banks and Family Offices

Diversified income and lower volatility

Aims to provide steady income generation opportunity, low correlations, and a historically lower volatility profile.

Insurance Companies

Capital efficiency and compelling returns

Offers a compelling capital treatment and returns compared to traditional fixed income with a similar credit profile.

Corporate Treasurers

Strategic solution

Quality option for longer-term strategic allocations.

Insights from our experts

Why now for Securitised Credit?

Hear from Andrew Jackson, Head of Securitised Credit and Paul Mitchell, Senior Fixed Income Specialist on the compelling investment case for allocating to Securitised Credit, what's happening in the market right now and what to expect going forward

Securitised Credit: Our Global Dynamic Approach

Hear from Andrew Jackson, Head of Securitised Credit, on why this asset class’s unique structural features matter for investors today, and how HSBC’s global expertise and specialised solutions empower investors to capture emerging opportunities

Resources

More insights on Securitised Credit strategies:

|

Understanding Securitised Credit |

Read time: |

|

|

Securitised Credit: What to expect going forward |

Read time: |

|

|

Securitised Credit global dynamic approach |

Read time: |

Why HSBC Asset Management for Securitised Credit?

|

|

|

|

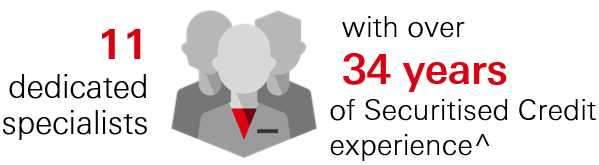

^ Source: HSBC Asset Management as at 30 June 2025 and subject to change. |

||

Investment Team |

|||||

|

Andrew Jackson Head of Portfolio Management, Securitised Investment team Andrew Jackson holds the responsibility for portfolio management and trading activities within the Securitised Credit investments team. He has been working in the industry since 1989. He holds a BA degree in Economics from Exeter University and is an Associate of the Institute of Chartered Accountants. |

|

Paul Mitchell Senior Investment Specialist Paul Mitchell is a senior investment specialist for the Global, Securitised and Sterling Fixed Income capabilities at HSBC Asset Management and brings over 27 years of asset management experience to the role. He holds an honours degree in Economics from Kingston University and the Investment Management Certificate. |

|

Jai Lakhani Investment Specialist Jai Lakhani is an investment specialist for the Global, Securitised and Sterling Fixed Income capabilities at HSBC Asset Management and brings over 10 years’ experience to the role. He holds an honours degree in Economics from Warwick University and the Investment Management Certificate. Jai is also a CFA charterholder. |

Key risks

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

- Interest Rate Risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements.

- Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

- Credit Risk: Issuers of debt securities may fail to meet their regular interest and/or capital repayment obligation. All credit instruments therefore have the potential for default. Higher yielding securities are more likely to default.

- Default Risk: The issuers of certain bonds could become unwilling or unable to make payments on their bonds.

- Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

- Exchange Rate Risk: Investing in assets denominated in a currency other than that of the investor’s own currency perspective exposes the value of the investment to exchange rate fluctuations.

- Investment Leverage Risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

- Asset Backed Securities (ABS) Risk: ABS are typically constructed from pools of assets (e.g. mortgages) that individually have an option for early settlement or extension, and have potential for default. Cash flow terms of the ABS may change and significantly impact both the value and liquidity of the contract.

- Derivative Risk: The value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivative. Unlike exchange traded derivatives, over-the-counter (OTC) derivatives have credit risk associated with the counterparty or institution facilitating the trade.

- High Yield Risk: Higher yielding debt securities characteristically bear greater credit risk than investment grade and/or government securities.

- Liquidity Risk: Liquidity is a measure of how easily an investment can be converted to cash without a loss of capital and/or income in the process. The value of assets may be significantly impacted by liquidity risk during adverse markets conditions.

- Operational Risk: The main risks are related to systems and process failures. Investment processes are overseen by independent risk functions which are subject to independent audit and supervised by regulators.

Further information on the potential risks can be found in the Prospectus or Offering Memorandum.

Disclaimer

Important Information

This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment nor should it be regarded as investment research. This advertisement has not been reviewed by The Monetary Authority of Singapore (the “MAS”).

HSBC Global Asset Management (Singapore) Limited (“AMSG”) has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Any views and opinions expressed in this document are subject to change without notice. It does not have regard to the specific investment objectives, financial situation, or needs of any specific person. Investors and potential investors should not make any investment solely based on the information provided in this document and should read the offering documents (including the risk warnings), before investing. Investors should seek advice from an independent financial adviser. Investment involves risk. Past performance and any forecasts on the economy, stock or bond market, or economic trends are not indicative of future performance. The value of investments and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may significantly affect the value of the investment.

This document is provided for information only.

In Singapore, this document is issued by AMSG who is licensed by MAS to conduct Fund Management Regulated Activity in Singapore. AMSG is not licensed to carry out asset or fund management activities outside of Singapore.

HSBC Global Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: https://www.assetmanagement.hsbc.com.sg/

Company Registration No. 198602036R