Real Estate APAC

Dedicated Asia Pacific direct Real Estate investment manager

What’s new

Inside HSBC’s real estate reboot

Who we are

Our Real Estate APAC team provides investors access to value-add and core-plus investment approaches, leveraging our long track record and presence in the region.

Significant resources with deep

|

General Partners retain “Skin-in-the-game”

|

Established business with proven track record

|

Differentiated investment approach with deep relationship network

|

Source: HSBC Asset Management, as of June 2024

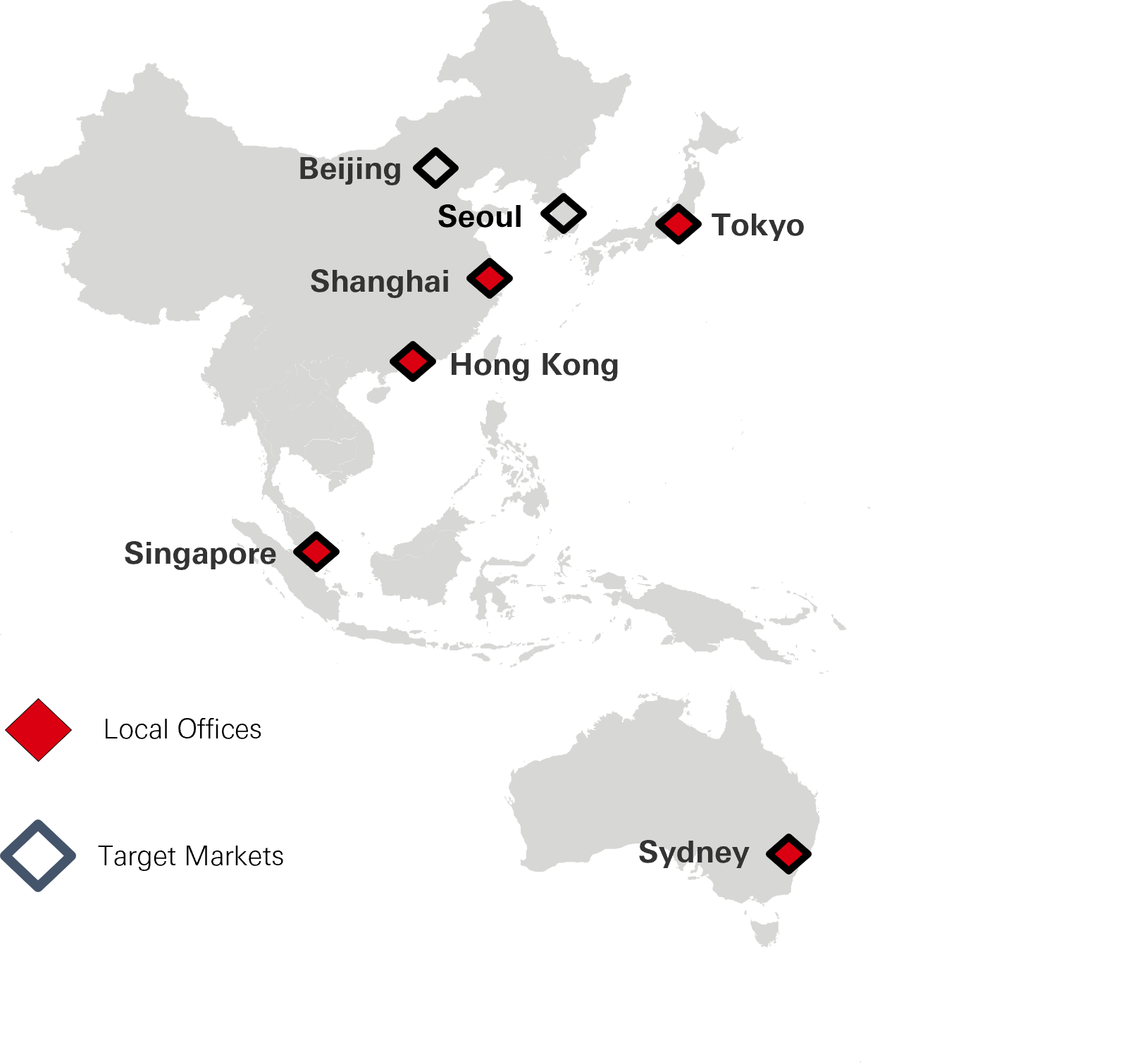

We target the most mature, institutionalised, liquid and transparent markets in the Asia Pacific Region

Our Investment Approach

|

Invest

Optimise Execute SAP, which can include these active asset management initiatives to create value:

Realise

|

What we do

Our Portfolio

Our team currently manages over 20 properties in the region – representative properties include:

Experienced Investment Team

Average years of experience of senior leadership |

Average years key investment members have worked as a team |

Investment professionals based locally across APAC |

Please note that some of the strategies listed above, may not have an underlying fund registered as a Recognised or Restricted Scheme in Singapore and hence, may not be available for offer in Singapore. This section is for purpose of showcasing HSBC AM’s Real Estate capabilities

Our Team

25 investment professionals locally based across APAC

Peter Wittendorp, CEFA Head of Real Estate, APAC 30 years of real estate experience |

|||

Berend Poppe, CFA Head of China 20 years real estate experience |

Nick Kearns, CFA Head of Hong Kong 20 years real estate experience |

George Kang Head of Singapore 20 years real estate experience |

Takashi Hamajima Head of Japan 20 years real estate experience |

Contact us

Key Risks

Important Information

This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment nor should it be regarded as investment research. This document has not been reviewed by The Monetary Authority of Singapore (the “MAS”).

HSBC Global Asset Management (Singapore) Limited (“AMSG”) has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Any views and opinions expressed in this document are subject to change without notice. It does not have regard to the specific investment objectives, financial situation, or needs of any specific person. Investors and potential investors should not make any investment solely based on the information provided in this document and should read the offering documents (including the risk warnings), before investing. Investors should seek advice from an independent financial adviser. Investment involves risk. Past performance and any forecasts on the economy, stock or bond market, or economic trends are not indicative of future performance. The value of investments and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may affect significantly the value of the investment.

This document is provided upon request for information only.

In Singapore, this document is issued by AMSG who is licensed by MAS to conduct Fund Management Regulated Activity in Singapore. AMSG is not licensed to carry out asset or fund management activities outside of Singapore.

HSBC Global Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: https://www.assetmanagement.hsbc.com.sg/

Company Registration No. 198602036R

Experienced leadership team

Experienced leadership team