Energy Transition Infrastructure

What’s new

As the world transitions towards a low-carbon economy, the HSBC AM Energy Transition Infrastructure (ETI) strategy taps into the opportunities arising from the global demand for energy transition investments. The ETI strategy has an illustrated gross IRR of 15-20 per cent1, and assists in the transition to a more sustainable economy.

1. Any forecast, projection or target when provided is indicative only and is not guaranteed in any way. Illustrated using model and assumption and may not reflect actual fund’s performance

The Asian Energy Transition - The Future of Infrastructure Investing

The Asian Opportunity

Estimated Energy Supply Investment to reach Net Zero, select regions (2020-50)

The opportunity - at a glance

|

Asia-Pacific will require an estimated USD15tn energy supply investment to reach Net Zero, 2020-20502 |

A substantial portion of that will be in infrastructure assets, our core investment focus. |

We believe that the growing demand for clean energy will create room for scalability within our strategy. |

A Regional Growth Opportunity

- The largest market opportunity in the space

- Asia’s fast-growing population and economic growth driving demand for energy

- Robust governmental support via regulatory regimes and policies

- Need to diversify energy sources away from fossil fuels

Developed Asia Markets

Australia, Hong Kong, Japan, Korea, New Zealand, Singapore, Taiwan

- Investment grade markets with net-zero ambitions

- Deep and liquid capital markets with increasing focus on sustainable energy investments

- Nascent sector with markets lag mature European counterparts in renewables capacity as % of total energy mix, greater scope for growth

- USD275bn investment in next 5 years in North Asia markets alone

Secondary Markets

South and Southeast Asia

- Fast growing regional markets including India, Indonesia, Malaysia, Philippines, Thailand and Vietnam

- Government targets for renewable energy generation

- Opportunistically looking at other OECD markets with nexus or expansion plans to Asia

Source: BloombergNEF NEO 2022; 2. APAC Data set excludes Mainland China, Tsinghua estimates for China 2021, IGCC estimates for Australia 2021, AIGCC estimates for other countries 2021

The Mid Market Opportunity

We believe that the mid-market can provide a greater breadth of deals at more compelling valuations

The Pillars of the Strategy

Opportunities in renewable regeneration, grids, energy storage, charging and meter infrastructure in developed Asia

|

ETI Pure Play |

Asia based team, for asian investment |

Mid-Market |

Value-Added |

A Regional Answer to a Global Issue

Leadership

Paul Rhodes Head of ETI APAC (Hong Kong) 25+ years in investment banking |

Rowan te Kloot Head of Investments ETI APAC (Singapore) 19+ years investing in renewables and infrastructure |

Ana Carolina Romero Investment Specialist (Singapore) 14+ years in PE, cap-intro, energy & infrastructure |

Andrew Wang 王浩晖 Investment Principal (Singapore) 13+ years in renewables, infra & TMT |

Clare Morton Senior Responsible Investment Specialist (Singapore) 12+ years in Responsible Investing |

Chris Yamane 山根 クリス Investment Associate Principal (Japan) 10+ years in renewables & industrial design |

Takayasu Hori 堀 隆泰 Industry Associate Principal (Japan) 16+ years in renewables & logistics |

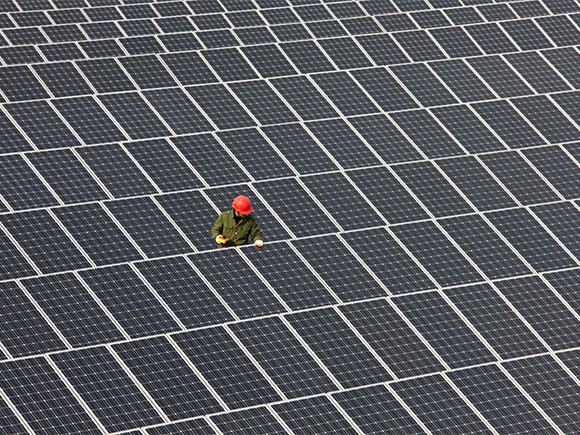

Our First Investment

The HSBC Asset Management ETI team has acquired a solar PV business focused on developing and operating energy transition projects across north Asia.

We expect the experienced management team to capture the sector opportunity in mature markets that are transitioning, with a robust pipeline of corporate Purchasing Power Agreement off-takers.

Contact us

If you are considering investing in alternatives, or want to learn more about our investment strategies, please get in touch.