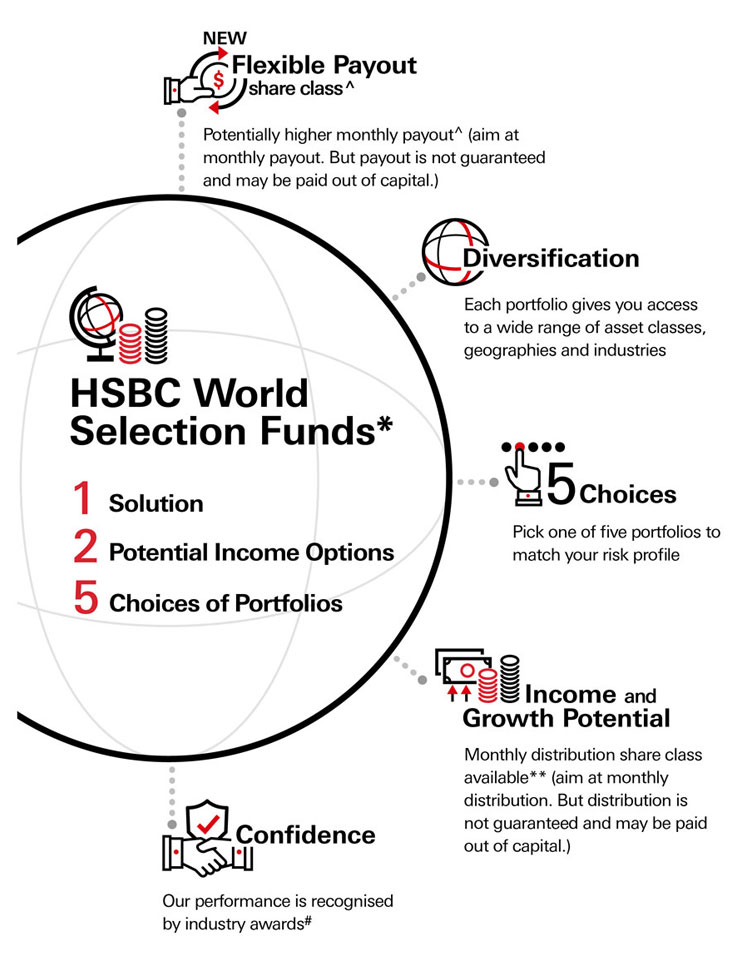

HSBC World Selection Funds*

Worrying about excessive market volatility? Are you looking for investments at lower risks that can still capture potential capital growth?

It is worrying to see wild swings in asset prices during market volatility. It’s therefore understandable that investors prefer a more defensive approach in times as such. However, being overly conservative might cost one the potential return from market rebound. Adopting a global multi-asset strategy could help diversify risks and income sources.

Under HSBC World Selection Funds there are five portfolios catering for investors with different risk appetites. World Selection 1 and 2 invest mainly in fixed income with relatively low volatility. Despite their defensiveness, they also include equities, property and alternative investments to help investors seize risk-reward opportunities.

World Selection 3 has a rather balanced allocation for both equities and bonds. World Selection 4 and 5 are heavier in equities, which suit investors with bigger risk appetite.

What are the options for income-seeking investors in a low-rate environment?

More conservative fixed-income instruments such as sovereign and investment-grade bonds tend to carry lower yields in a subdued rate environment, which may fall short of investors’ demand. A more balanced approach is to adopt a global and multi-asset strategy, which enables diversification of income sources, namely equities, fixed income, property and alternative assets. The idea is to include assets of different geographical markets and industries in a single basket. Such strategy not only enhances the stability of a portfolio, but also helps diversify and manage risks, and in turn generates potential return. Investors can also decide how defensive or aggressive their allocations to be based on his or her own risk appetites.

What is “Flexible Payout”? How does it differ from receiving monthly distribution?

Investors who are interested in receiving steady income are used to the monthly distribution share classes of a fund. Currently there are also flexible payout classes available in the market. They are not only factoring in expected return such as potential dividend yield, fixed income yield, cash yield, but also capital gains of all sorts, including unrealized ones.

The goal of flexible payout is to potentially increase investors’ current regular income through reaping a fund’s expected return in advance. That would enable them to flexibly deploy potential return for other expenses or investments. Investors should be aware that the payout is not guaranteed and can be paid out of the fund’s capital. The payout percentage under the flexible payout share class will potentially be higher than the monthly distribution share classes, though it is not guaranteed.

During market downturn, a fund might adjust its dividend and payout and its potential capital gain might be capped. The fund might also risk running into losses.1

1This share class deliberately pays out of net capital gains (both realised and unrealised). In addition, this share class will pay out of capital (or effectively out of capital). Paying-out of capital represents a withdrawal of investors’ initial investment. This may result in a substantial erosion of an investor’s initial investment over the long term. Over the very long term an investor’s initial investment may be nearly, or even completely, exhausted.

Accumulation share class versus distribution share class - which is better?

Investors who want to maximize their capital gain will opt for the accumulation class, even if that means foregoing regular income. This class will reinvest the dividend from assets in the portfolio on their respective ex-dividend dates into additional units of the fund based on its net asset value. The goal is to accumulate capital gains and compound interest income. It is designed to deliver higher return in the long run, catering for investors who seek capital gain through long-term investments.

Monthly distribution aims at providing potential monthly cash flow to investors, which can be deployed for expenses or other investment purposes.

The two strategies are designed for different purposes. Investors can choose between accumulation share class and distributions share class based on their personal goals and needs.

Understanding the Flexible Payout share class

Investors seeking regular potential income could diversify the investment by means of global multi-asset strategy and strive for income by weighing the different distribution policies offered by different share classes based on their financial needs.

Getting started

* The full name is HSBC Portfolios - World Selection 1, World Selection 2, World Selection 3, World Selection 4, World Selection 5. Consisting of 5 separate portfolios, each portfolio invests independently to achieve its set objectives.

# Thomson Reuters Lipper Fund Awards 2018 - Singapore, World Selection 3 (AC) awarded with Mixed Asset USD Bal Global – 5 years. Based on calendar year performance in 2017.

Benchmark Fund of the Year Awards 2018 Singapore, Word Selection 2 (AC) awarded with Outstanding Achiever – Mixed Assets Conservative Allocation; Word Selection 5 (AC) awarded with Best in Class – Mixed Assets Aggressive Allocation. Based on the performance as of 31 August 2018.

Benchmark Fund of the Year Awards 2017 Singapore, Word Selection 1 (AC) awarded with Best in Class – Cautious Allocation; Word Selection 5 (AC) awarded with Best in Class – Aggressive Allocation. Based on the performance as of 31 August 2017.

Benchmark Fund of the Year Awards 2016 Singapore, Word Selection 4 (AC) awarded with Outstanding Achiever – Aggressive Allocation. Based on the performance as of 31 August 2016.

^ Flexible Payout share class deliberately pay out of net capital gains (both realized and unrealised). In addition, these Classes will pay out of capital (or effectively out of capital). These Classes may pay out of capital over a prolonged or indefinite period. Paying out of capital represents a withdrawal of investors’ initial investment. This may result in a substantial erosion of an investor’s initial investment over the long term. Over the very long term an investor’s initial investment may be nearly, or even completely, exhausted. Payout is not guaranteed and may result in capital erosion and reduction in net asset value. The Fund may pay payouts out of capital or gross of expenses. Any forecast, projection or target contained herein is for information purposes only and is not guaranteed in any way.

** Refers to AM class: Dividend is not guaranteed and may be paid out of capital which will result in capital erosion and reduction in net asset value. The Fund may pay dividends out of capital or gross of expenses. Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors.

Source: HSBC Global Asset Management, as of 31 July 2019, NAV to NAV in USD with dividend reinvested. Calendar year performance of HSBC World Selection 1: 9.0% (YTD 2019); -3.6% (2018); 6.5% (2017); 4.4% (2016); -1.4% (2015); 5.7% (2014). HSBC World Selection 2: 10.8% (YTD 2019); -5.2% (2018); 8.8% (2017); 5.7% (2016); -1.7% (2015); 5.2% (2014). HSBC World Selection 3: 12.9% (YTD 2019); -8.1% (2018); 13.7% (2017); 6.5% (2016); -2.8% (2015); 4.0% (2014). HSBC World Selection 4: 14.9% (YTD 2019); -10.5% (2018); 18.3% (2017); 6.3% (2016); -3.9% (2015); 3.2% (2014). HSBC World Selection 5: 15.6% (YTD 2019); -10.8% (2018); 19.9% (2017); 5.9% (2016); -4.2% (2015); 2.7% (2014).

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Important Information:

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Investors and potential investors should not invest in the Fund solely based on the information provided in this document and should read the prospectus (including the risk warnings) and the product highlights sheets, which are available upon request at HSBC Global Asset Management (Singapore) Limited (“AMSG”) or our authorised distributors, before investing. You should seek advice from a financial adviser. Investment involves risk. Past performance of the managers and the funds, and any forecasts on the economy, stock or bond market, or economic trends that are targeted by the funds, are not indicative of future performance. The value of the units of the funds and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may affect significantly the value of the investment. AMSG has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information.

HSBC Global Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: www.assetmanagement.hsbc.com/sg

Company Registration No. 198602036R