Power up your portfolio

Seize the opportunities through multi-asset and active fixed income solutions

Why it’s time to put cash to work

Usually in a high-interest rate environment, investors are rewarded for holding cash. Now, falling interest rates are likely to result in lower prospective returns on cash within portfolios.

|

|

Our Capabilities

Our Strategies

Build your knowledge

Leverage our expertise to understand more about investing in fixed income and multi-asset assets such as bonds, equities and alternatives.

Power up your portfolio with multi-asset solutions from HSBC AM |

Introduction to bonds |

Basics of bond prices, bond yields and duration |

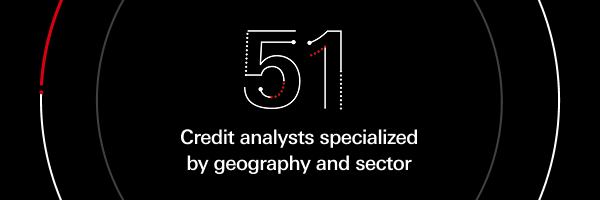

Fixed income and multi-asset experts

Markets are always in flux, and 2025 may be a year of profound global change. That’s why it may be beneficial to consider actively managed strategies when powering up your investments.

Active fixed income

A recognized, specialized manager.

Global insights, local expertise Supported by global research teams, our approach integrates rigorous global processes with local insights, fostering decision-making that blends investment discipline with collective thinking. |

Research-driven and flexible Our active fundamental approach is research-driven with a strong focus on relative valuation. In emerging and credit markets, we leverage bottom-up credit research and top-down macro analysis to exploit gaps between risk premiums and fundamentals. |

Risk adjusted outcomes We strive to identify, price and integrate risks into our investment process. Intensive research underpins our ability to deliver consistent results. |

Source: HSBC Asset Management as at 30 Sept., 2024.

Active multi-asset

Markets are cyclical, our multi-asset team’s approach is not.

Structured and consistent Our disciplined investment process integrates quantitative and qualitative insights with a clear focus on diversification and risk management. Complemented by a rigorous fulfilment process, it ensures efficient, cost-effective targeted allocations. |

Research-driven Leveraging research and proprietary tools, we analyze factors like value, macro trends and risk to identify opportunities. This approach supports dynamic asset allocation and disciplined portfolio construction for strong risk-adjusted returns. |

Collaborative approach We emphasize a team-based process, fostering collaboration and dialogue. Our multi-asset platform draws on macro and ESG insights and leverages fixed income and equity team expertise for effective fulfilment. |

Source: HSBC Asset Management as at 30 Sept., 2024.

Key Risks

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. You may not get back the full amount invested.

- Interest Rate Risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements

- Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

- Credit Risk: Issuers of debt securities may fail to meet their regular interest and/or capital repayment obligation. All credit instruments therefore have the potential for default. Higher yielding securities are more likely to default

- Default Risk: The issuers of certain bonds could become unwilling or unable to make payments on their bonds

- Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks

- Exchange Rate Risk: Investing in assets denominated in a currency other than that of the investor’s own currency perspective exposes the value of the investment to exchange rate fluctuations

- Investment Leverage Risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source

- Asset Backed Securities (ABS) Risk: ABS are typically constructed from pools of assets (e.g. mortgages) that individually have an option for early settlement or extension and have potential for default. Cash flow terms of the ABS may change and significantly impact both the value and liquidity of the contract.

- Derivative Risk: The value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivative. Unlike exchange traded derivatives, over-the-counter (OTC) derivatives have credit risk associated with the counterparty or institution facilitating the trade

- High Yield Risk: Higher yielding debt securities characteristically bear greater credit risk than investment grade and/or government securities.

- Liquidity Risk: Liquidity is a measure of how easily an investment can be converted to cash without a loss of capital and/or income in the process. The value of assets may be significantly impacted by liquidity risk during adverse markets conditions

- Operational Risk: The main risks are related to systems and process failures. Investment processes are overseen by independent risk functions which are subject to independent audit and supervised by regulators

- Sustainability Risk: Sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment

- Further information on the potential risks can be found in the Product Highlights Sheet (PHS) and/or the Prospectus or Offering Memorandum

Important Information

HSBC Global Asset Management (Singapore) Limited (“AMSG”) has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Any views and opinions expressed in this document are subject to change without notice. It does not have regard to the specific investment objectives, financial situation, or needs of any specific person. Investors and potential investors should not make any investment solely based on the information provided in this document and should read the offering documents (including the risk warnings), before investing. Investors should seek advice from an independent financial adviser. Investment involves risk. Past performance and any forecasts on the economy, stock or bond market, or economic trends are not indicative of future performance. The value of investments and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may significantly affect the value of the investment.

This document is provided for information only.

In Singapore, this document is issued by AMSG who is licensed by MAS to conduct Fund Management Regulated Activity in Singapore. AMSG is not licensed to carry out asset or fund management activities outside of Singapore.

HSBC Global Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: https://www.assetmanagement.hsbc.com.sg/

Company Registration No. 198602036R