Building the future together

Working towards a low carbon Future

HSBC GIF Global Lower Carbon Bond

The HSBC GIF Global Lower Carbon Bond Fund is a non-traditional global corporate bond fund which has at least a 40 per cent lower carbon score, without sacrificing the returns seen in a more tradition corporate bond fund. The Fund incorporates ESG factors in its construction of a robust investment universe and seeks to provide long-term gains with a reduced carbon footprint approach, by investing in high-quality bonds in worldwide markets.

Why carbon reduction needs to be addressed?

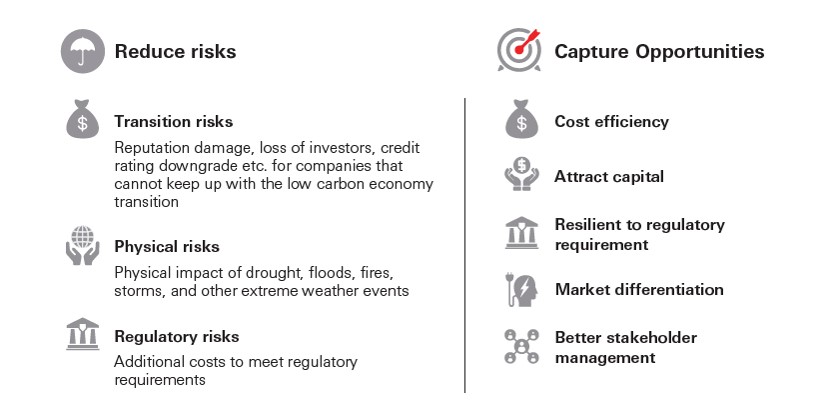

Carbon issues are becoming more and more prevalent due to heightened pressure from regulatory authorities and investors. Some companies are gearing up for the transition, while others will struggle and the market has yet to differentiate between the two:

- Those that will struggle relative to their peers should experience a widening in their spreads, downgrades and even defaults due to:

- regulatory fines

- higher prices for carbon usage and lower oil prices as cheaper alternative energy becomes mainstream

- lack in competitiveness

- While those that are focused on carbon reduction should stand to gain.

The HSBC GIF Global Lower Carbon Bond Fund was developed as a solution to address the key issue of how can one reduce their carbon footprint without sacrificing returns.

|

|

|

The reality of climate change poses a threat to both the global economy and companies, making it a key risk for investors |

|

|

|

Investing in companies that have solid plans to limit their carbon footprint can minimise portfolio risk and increase opportunities to outperform |

|

|

|

International agreements, regulatory frameworks and public sentiment create enhanced awareness regarding carbon issues |

|

|

|

By investing in a lower-carbon fund, you can support actions to minimise the negative impact of CO2 emissions |

HSBC GIF Global Lower Carbon Bond; Addressing carbon reduction without sacrificing returns

- A sustainable, non-traditional global corporate bond fund

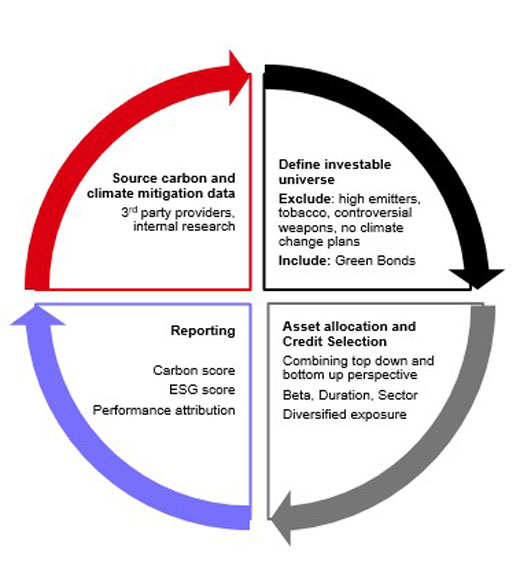

- The Fund aims to deliver on its objectives through the following approach:

- Targeting at least 40% less carbon versus the benchmark with the same performance and risk metrics as our traditional credit strategy

- Robust universe construction – incorporating ESG factors

- Focus on companies – across industries – with explicit carbon mitigation plans and avoiding those most likely to fail

- Accountability through rigorous reporting and measurement

Why invest in HSBC GIF Global Lower Carbon Bond ?

The fundamental cause of climate change is carbon emission, To control carbon emissions, they must first be accurately measured and the two key measurements are tracking carbon footprint and carbon intensity.

A custom process is applied to the HSBC GIF Lower Carbon Bond Fund where the carbon footprint associated with each bond is measured, and then so the carbon footprint of the overall fund can be assessed as a whole. This approach the fund’s carbon footprint to be reduced significantly, while at the same time targeting potential returns that are better than the benchmark

|

|

Capture benefits of lower carbon companies while avoiding climate-related risks. |

|

|

Maximize potential returns while reducing portfolio carbon intensity. |

|

|

Exposure to a portfolio of corporate bonds with a lower carbon footprint, and who can bear the risk of the underlying investments. |

|

|

Potential Diversification benefits; Exposure to different industries and regions capture a wide range of opportunities. |

Fund details

|

Fund domicile |

Luxembourg |

|

Fund Inception date |

27 September 2017 |

|

Base currency |

USD |

|

Recommended investment horizon |

Minimum 5 years |

|

ISIN |

AC : LU1674672883 |

|

Fees (maximum) |

Management Fee: 0.8% |

|

Minimum initial investment |

AC : USD 1,000 |

|

Fund is available at: |

HSBC Private Banking Singapore and HSBC Singapore |

Investor Resources

|

|

-

Sustainable investments

Solutions based on client need, designed to mitigate risk and capture opportunities around environmental, social and governance (ESG) issues. -

Important information

Risk

- Risk Considerations. There is no assurance that a portfolio will achieve its investment objective or will work under all market conditions. The value of investments may go down as well as up and you may not get back the amount originally invested. Portfolios may be subject to certain additional risks, which should be considered carefully along with their investment objectives and fees.

- Fixed income is subject to credit and interest rate risk. Credit risk refers to the ability of an issuer to make timely payments of interest and principal. Interest rate risk refers to fluctuations in the value of a fixed income security that result from changes in the general level of interest rates. In a declining interest rate environment, a portfolio may generate less income. In a rising interest-rate environment, bond prices fall.

- Derivative instruments. Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

- Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets.

- High Yield. Investments in high yield securities (commonly referred to as “junk bonds”) are often considered speculative investments and have significantly higher credit risk than investment grade securities. The prices of high yield securities, which may be less liquid than higher rated securities, may be more volatile and more vulnerable to adverse market, economic or political conditions.

- Exchange Rate Risk. Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

- Counterparty Risk. The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

- Liquidity Risk. Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

- Operational Risk. Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

- Interest Rate Risk. When interest rates rise, bond values generally fall. This risk is generally greater the longer the maturity of a bond investment and the higher its credit quality.

- Default Risk. The issuers of certain bonds could become unwilling or unable to make payments on their bonds.

- Credit Risk. A bond or money market security could lose value if the issuer’s financial health deteriorates.

- CoCo Bond Risk. Contingent convertible securities (CoCo bonds) are comparatively untested, their income payments may be cancelled or suspended, and they are more vulnerable to losses than equities and can be highly volatile.

This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

This advertisement has not been reviewed by the Monetary Authority of Singapore. This document is for information only and is not an investment recommendation, research, or advice. Any views and opinions expressed are subject to change without notice. It does not have regard to the specific investment objectives, financial situation, or needs of any specific person. Investors and potential investors should not invest in the Fund solely based on the information provided in this document and should read the prospectus (including the risk warnings) and the product highlights sheets, which are available upon request at HSBC Asset Management (Singapore) Limited (“AMSG”) or our authorised distributors, before investing. You should seek advice from a financial adviser. Investment involves risk. Past performance of the managers and the funds, and any forecasts on the economy, stock or bond market, or economic trends that are targeted by the funds, are not indicative of future performance. The value of the units of the funds and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may affect significantly the value of the investment. AMSG has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information.

HSBC Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: www.assetmanagement.hsbc.com/sg

Company Registration No. 198602036R